July EUA Update, REPowerEU Frontloading to Start

<1 Min. Read Time

Markets were fairly quiet this week. BloombergNEF released its July EUA outlook yesterday. A main focus of the report was the confirmed 16.2 million frontloaded allowances that will be added to the market starting this year to help fund the REPowerEU initiative. Roughly 3.2 million frontloaded allowances are scheduled for auction in July.

Over the course of the next few years, the EU will take some allowances originally designated for future auctions (scheduled during 2027-2030) and add them to the current market supply. This added supply will help fund the bloc’s €20 billion initiative to advance Europe’s overall energy security and transition to low-carbon energy sources. This frontloading will ease supply in the near term though this has mostly been priced in already. Besides, it will lead to tighter supply and potential upward price pressure in the latter half of the decade.

EUA saw some price swings in June as a spectator short squeeze and rising gas prices pushed EUAs above €90. On June 6, investment funds' short positions slumped to a five-year low at -25 million EUAs net short and then, over the next two weeks, rebounded back to -2 million EUAs. Prices hit a high of €95 on June 20, though have since come down to the mid-high €80 range. Following that run-up, speculator activity has been more muted.

Looking ahead, there aren’t really any strong fundamental factors expected to move the market in the near term. We could see EUAs follow natural gas, which with some extended plant outages, could see prices rise. BNEF noted that the reduced industrial demand and an expected pick-up in renewable power generation could weigh on the market. However, July temperatures are anticipated to be higher than average with some potential heat waves, which would lead to greater cooling demand and therefore demand for EUAs.

Carbon Market Roundup

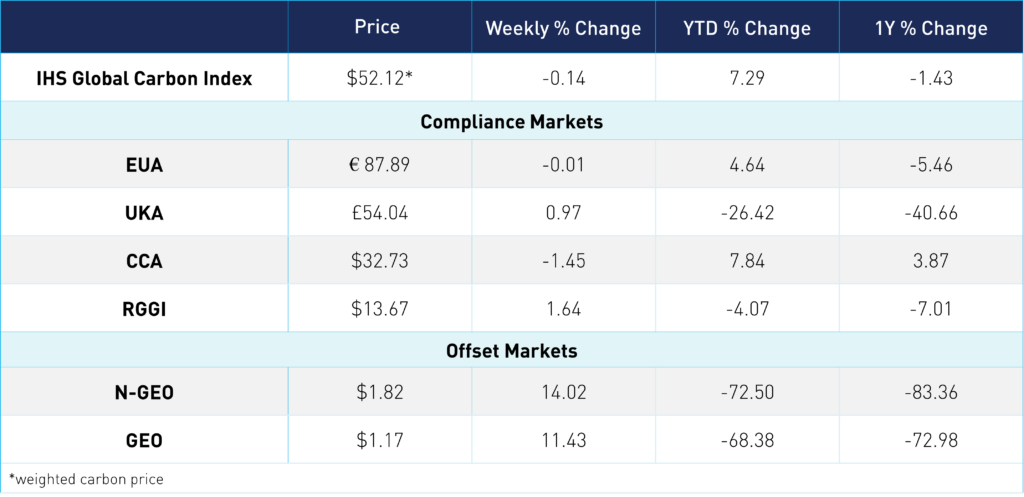

The global price of carbon is $52.12, slightly down 0.14% for the week. EUAs closed at €87.89, roughly the same level as the week prior. UKAs ended at £54.04, up a slight 0.9%. CCAs have drifted below the $33 level, closing at $32.73, -1.5% lower week-over-week (WoW). RGGI prices saw some momentum earlier in the week, up an overall 1.6% to close at $13.67. Both offsets markets jumped higher into Thursday, with N-GEOs up 14.1% WoW at $1.82 and GEOs up 11.4% WoW at $1.17.