As Smoke Shrouds NYC Skies, EUAs Rise 10% for the Week

3 Min. Read Time

On Wednesday, KraneShares held its second annual Global Climate and Carbon Investment Summit at the New York Stock Exchange. The sessions covered everything from the role of cap and trade and carbon credits to clean technology investment and the electric vehicle ecosystem. For those that were unable to attend, a replay of the event will be available shortly.

That same day, NYC was shrouded in a smoky, orange haze from the Canadian wildfires. At its peak in the afternoon, the Air Quality Index reached a record 405, higher than that seen in some of the most polluted cities in the world. This week's wildfire smoke underscores the accelerating impact of climate change, and how its reshaping natural hazards in our own backyard.

EUA Update

European carbon prices posted strong gains today though are still below that of February's record highs following dampened EU macroeconomic outlook and more moderate demand for carbon permits, even while energy costs have dropped sharply. However, the recent formal approval of the "Fit for 55" package of reforms to the EU ETS has played a significant role in reinforcing the positive outlook for carbon, instilling a sense of confidence in its long-term prospects. December 2023 EU allowance futures are currently around €86, having traded between €79 and nearly €100 over the last three months.

The month of May was marked by the publication of verified emissions data for 2022, which showed that emissions had risen by just under 1% despite expectations of a larger annual increase from the widespread shift from natural gas to coal for power generation in the wake of Russia's invasion of Ukraine. Moreover, industrial emissions saw an even bigger drop for the year. Energy-intensive industries like cement, steel, and fertilizers decided to reduce production amid soaring gas prices, also cutting emissions.

The formal approval of the "Fit for 55" package of reforms to the EU ETS has strengthened the longer-term outlook for carbon, but the near term is beset by concerns over falling demand and increased supply. With natural gas prices now in the €30-40/MWh range, this has flipped the power generation merit order back in favor of gas. Data from the Fraunhofer Institute shows that EU power generation from hard coal and lignite in May totaled 19.28 GWh, compared to 29.77 GWh a year earlier. At the same time, gas-fired generation fell from 29.67 GWh in May 2022 to 22.47 GWh last month, so the switch has not been like-for-like, as renewables generation has risen by nearly 10% over the same period. Meanwhile, industrial power demand is said to have fallen over the past few months as Europe's economic outlook worsens. Data from national governments show that in March, for example, Eurozone industrial output fell 2.5% month-on-month and was up just 0.9% year-on-year.

After this summer, the carbon permit supply is also set to increase. Firstly, the REPowerEU initiative will add some 16.5 million EUAs, frontloaded from future auctions, to the market's supply starting in September, with the revenue going towards funding the bloc's transition away from Russian fossil energy. In addition to this frontloaded supply, 270 million EUAs will be withdrawn from the market between September 2023 and August 2024 and placed into the market stability reserve (MSR), less than the nearly 350 million EUAs in the same period last year. The MSR helps manage market imbalances by adjusting the supply of allowances by either injecting or releasing allowances depending on how the total number of allowances in circulation (TNAC) falls within the predetermined threshold. The 2022 TNAC at 1,135 million was greater than the upper bound threshold of 833 million, which resulted in the mechanisms' 24% withdrawal rate from the market.

Prices have a more balanced outlook as the summer holiday period approaches. Fundamental factors suggest prices may continue to fall in the short term. Still, a number of stakeholders have pointed out that the market consumes more EUAs than are issued each year, which will continue to tighten the overall supply over time.

Carbon Market Roundup

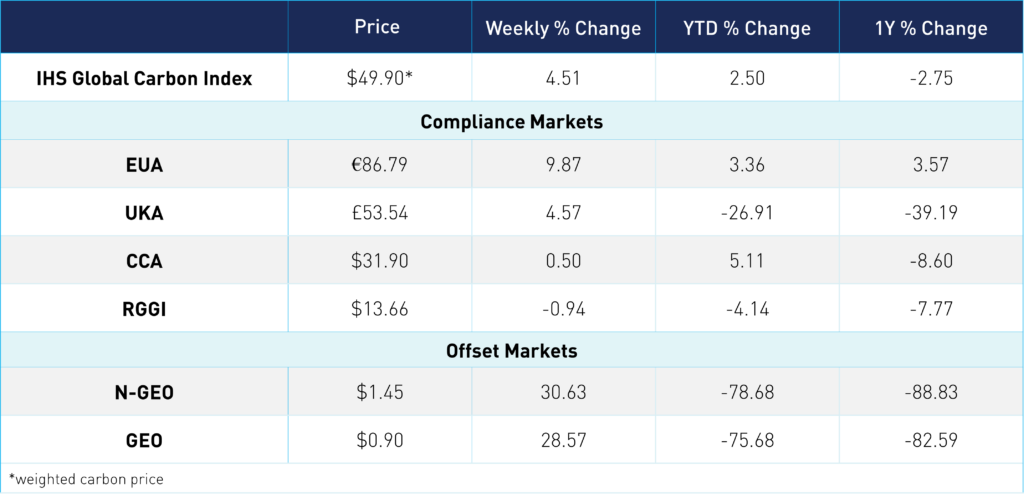

The global price of carbon was up 4.5% for the week, at $49.90. EUAs had an impressive rebound, up nearly 10% overall for the week to end at €86.79. EUA prices saw the largest jump on Friday, up over 3% following strong auction results and gains in the energy markets. UKAs were also up nearly 5% for the week, ending at £53.54. CCAs continue to trade in a narrow range, remaining mostly at the mid-$31 level though currently moved up slightly today to $31.90. RGGI prices also remained stable at the mid $13 level, currently trading at $13.66. The offsets markets both saw strong upward momentum this week, with N-GEOs at $1.45 and GEO at $0.90.