China’s ETS: Overview of World’s Largest Carbon Market

3 Min. Read Time

China's national emissions trading system is about to enter its third year of operation. After its much-vaunted launch in 2021, progress has been relatively slow in developing the market both in terms of its coverage and its nature.

The country's ETS is the world's largest in terms of coverage – estimated at more than 4 billion tonnes of CO2 a year from 2,000 companies. Yet, the market covers just the power generation sector, which is estimated to represent about 45% of China's total emissions.

The market is also not yet a fully-fledged cap-and-trade market like that of the European and Californian markets. While those markets set an absolute limit on the volume of CO2 that can be emitted, China's system instead caps the emissions intensity of its power plants, i.e., the amount of greenhouse gases per unit of output. In other words, their intensity-based system means that overall emissions can still increase as long as output grows as well.

The national ETS sets a target of cutting emissions per unit of GDP by 18% compared to 2020 levels by 2025. The government aims to reach peak emissions before 2030 while lowering GHG emissions per unit of GDP by 65% from 2005 levels.

As the country gains experience with emissions trading, China's ETS will likely expand to cover additional sectors, including petrochemicals, steel and non-ferrous metals, paper, and aviation. Most recently, government officials have signaled further delays to the roll-out to other sectors, citing revisions of the allocation plan after the pandemic.

The regulator is also reviewing ways to improve emissions benchmarks for covered installations, verification of emissions, and data gathering. Currently, the market issues free allowances to installations based on their emission intensity benchmarks and load factor (operating rate). The benchmarks are divided into four broad categories: conventional coal-fired plants below and above 300 MW capacity, unconventional coal plants, and natural gas-fired units. Free allocation is expected to be replaced by an auctioning system, though there is no timetable for this change.

Compliance is achieved for coal plants by retiring emissions permits matching the free allocation, plus permits representing an additional 20% of verified emissions. Gas-fired plants must surrender their freely allocated permits. Failure to surrender the required number of permits attracts fines ranging anywhere from US$3,000 to US$75,000 and a corresponding deduction from the following year's free allocation of permits.

At present, only covered installations may trade Chinese carbon allowances, though there are plans to open trading to other institutions and eventually individuals. The ETS also allows the use of Chinese-certified emission reductions (CCERs) to cover a maximum of 5% of an installation's compliance obligations. Trading in the secondary market is restricted to one exchange – the Shanghai Environmental and Energy Exchange – and only physical trading is currently allowed. Allowance prices averaged $8.20/tonne in 2022, according to the International Carbon Action Partnership. We could see the market expand to include a futures market, as seen with other more mature markets.

The nationwide ETS is built around China's provincial carbon markets, which experiment with slightly different designs regarding coverage, allocation method, use of offsets, and even trading.

The main four regional markets are:

Chongqing: covers electrolytic aluminum, ferroalloys, calcium carbide, cement, caustic soda, iron and steel, and other industrial sectors.

- Cap: 78.4 MtCO2e (2020)

- CCERs: 8% maximum.

- Average price 2022: $5.86/tonne

Fujian: covers electricity grid, petrochemicals, chemicals, building materials, iron and steel, non-ferrous metals, paper, aviation and ceramics.

- Cap: 132 MtCO2e (2021)

- CCERs: 5% maximum, or 10% with the use of Fujian forestry credits

- Average price 2022: $3.37/tonne

Guangdong: covers cement, steel, petrochemicals, paper, and domestic aviation

- Cap: 265 MtCO2e (2021)

- CCERs: 10% maximum. Tan Pu Hui Certified Emission Reductions are also eligible.

- Average price 2022: $11.35/tonne

Hubei: covers any installation with annual energy consumption of more than 60,000 tonnes of coal equivalent

- Cap: 182 MtCO2e (2021)

- CCERs: 10% maximum

- Average price 2022: $6.95/tonne

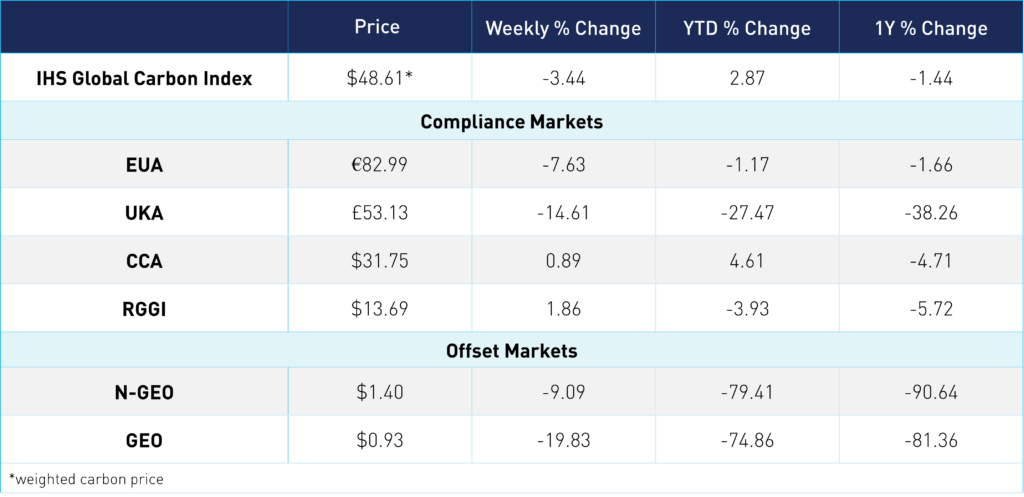

Carbon Market Roundup

The global price of carbon closed at $48.61, down 3.51% from last week. EUAs closed at €82.99, down 7.63%. The market opened the week at €87.76, down 2.36% from Friday, and then fell another 2.58% into Tuesday. News on Germany entering a recession and the 10% drop in front-month natural gas prices combined with continued short-selling caused EUA prices to fall even further today. UKAs also took a hit this week, down 14.61%, closing at £53.13. US markets continue to trade in a narrow range. CCA prices were up 0.89% at $31.75, and RGGI moved up 1.86% at $13.69. Yesterday, it was announced that California and Quebec would hold a joint meeting on June 14th to discuss potential amendments to their cap-and-trade systems, which should boost the market. N-GEOs traded within the $1.45-$1.65 range. GEOs dipped below the dollar mark for the first time today, currently at $0.93.

To learn more about our carbon credit ETFs, click here.