2022 Emissions Reduction Update, New Offsets Standards

3 Min. Read Time

Report Shows EU ETS Emissions Fell in 2022, EUAs Post 14% Rally Following Trading Data Release

Installations covered by the EU ETS reported emissions totaling 1.32 billion tonnes in 2022, a drop of 1.4% from 2021, according to the analysis of partial EU data by ICIS. The decline in emissions surprised most participants, who had been expecting a modest year-on-year rise in emissions as utilities had switched from gas to coal amid the energy crisis triggered by Russia’s invasion of Ukraine.

ICIS’ analysis of the EU data covered around 94% of the stationary plants participating in the market and excluded data from airlines. Carbon emissions have been falling steadily since 2008, when they totaled 1.835 billion tonnes, reaching a low of 1.224 billion tonnes as the bloc struggled in the grip of the Covid-19 pandemic. Major producers in energy-intensive sectors, including ammonia, fertilizers, steel, and even chemicals, announced cutbacks and even production suspensions after natural gas prices soared to more than €300/MWh as Europe scrambled to rebuild stocks ahead of the winter.

If confirmed by final EU data, the decline in total emissions in 2022 would add to the overall surplus in the market and cause the Market Stability Reserve to remove a higher volume of permits from the market in September. The European Commission will publish the annual Total Number of Allowances in Circulation (TNAC) in May, confirming the total reduction in supply that will be applied later this year.

The carbon market has shrugged off the bearish implications of the data and rallied over the subsequent days to reach a high of €97.44 on Tuesday, representing an increase of 14% since the price fell to its recent low of €84.75 on March 20. EUA prices trended down slightly during the rest of the week, though remained in the mid-€90s. The rally was, in part, a reaction to data that showed investment funds had cut their net long positions to the lowest in two months. The Commitment of Traders data from the two main exchanges showed that investors held an aggregate of 30.7 million EUAs in long positions and 26.2 million in short positions.

Three weeks prior, funds had held a net long position of more than 20 million EUAs, and the liquidation of this length was thought to be behind the nearly €10 plunge in prices in mid-March. However, traders also use investor holdings data as a directional signal. Some participants have said the drop in net length was taken as a sign to buy, triggering the recent 14% rally.

At the same time, EU member states have started to hand out the portion of EUAs that industrials are entitled to receive free of charge. EU data show that as of March 16, around 326 million or 62% of the free handout had been distributed. At the same time, the annual compliance cycle is reaching its peak. Industrial installations and airlines must surrender EUAs matching their verified emissions by April 30, and this has generated some buying activity. However, some market participants have cautioned that industrial demand may be insignificant this year after many plants were turned down or put on stand-by in 2022 amid the energy crisis. But others have pointed out that high energy prices last year also dissuaded many industrials from contracting for forward energy supplies. A resumption of forward buying would lead to renewed demand to hedge fuel and carbon costs, which will likely sustain the market in Q1 and later.

Integrity Council Publishes New Standards for the Offsets Market

At the end of March, the Integrity Council for the Voluntary Carbon Market (IC-VCM) published its Core Carbon Principles (CCPs), a set of threshold standards for the voluntary carbon credit sector. The guidelines have no formal regulatory standing. However, the IC-VCM will assess crediting programs and offset projects for their alignment with its standards and issue CPP “tags” to eligible credits. The CPPs set broad thresholds for program transparency and governance, robust verification, environmental integrity, adherence to sustainable development goals, and additionally. The IC-VCM will also assess individual crediting programs in the coming months.

The CPPs represent an effort to bring together a disparate sector in which numerous programs set their own standards and guidelines. The voluntary carbon market also faces the emergence of an UN-regulated standard that is under development as part of the Paris Agreement. The so-called Article 6 mechanism will act as a global standard for both countries and interested private sector participants. A Supervisory Body is responsible for approving projects and issuing carbon credits with a UN label, which governments can use to meet their Paris Agreement Nationally Determined Contributions (NDCs).

RGGI Emissions Reduction Progress, Coal-fired Generation Falls to 2% of Supply

A report by the Acadia Center found that emissions in nine core RGGI states totaled 67.3 million short tons in 2022, 9.5% below the 2021 cap and 48% below 2008 emissions. The program has led to coal-fired power generation falling from 22% of total core RGGI supply to just 2% between 2008 and 2021, compared to 24% in the rest of the United States.

At the same time, renewables generation in the core RGGI states has increased from 12% to 18% of the total over the same period. The Acadia study cautioned that emissions have recently increased, growing by 9.5% between 2019 and 2021 due to the COVID-19 pandemic and a 3.2% decline in net electricity generation in the core RGGI states.

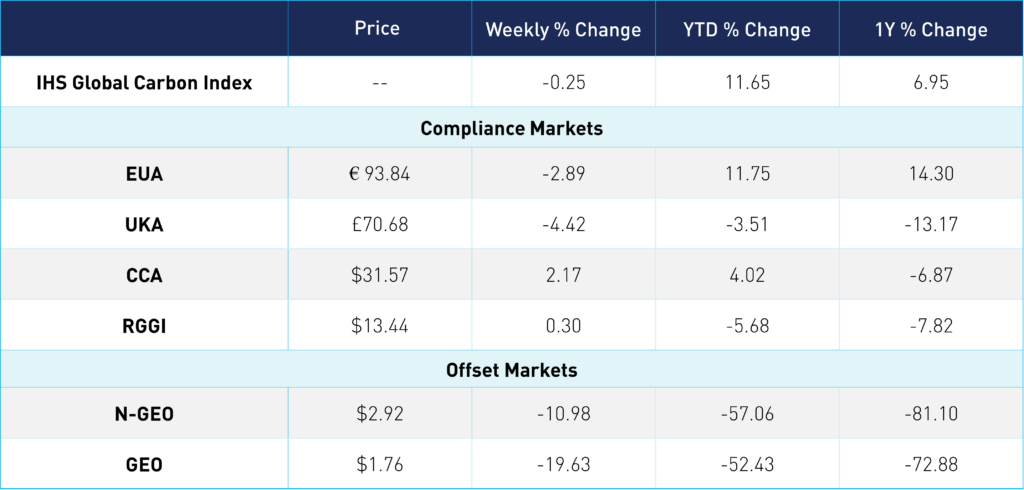

Carbon Market Roundup

EUAs were down -2.89% for the week at €83.84, while UKAs fell 4.42% at £70.68. CCA prices trended up 2.17% to reach $31.57. The RGGI market saw little change over the week, with RGA price at $13.44. Offset prices for N-GEOs and GEOs were both on the decline, dropping to $2.92 and $1.76, respectively.