EU Carbon Prices Rally as Commission Confirms First Sale of Additional EUAs

2 Min. Read Time

The European Commission announced this week that it plans to sell at least 16.5 million EUAs starting in July as part of its recently-approved REPowerEU initiative. Further volumes will be added to the sale as soon as regulations governing other sources of allowances are amended.

The REPowerEU plan includes the sale of €20 billion worth of EUAs to help fund the EU’s shift away from Russian energy and to speed up the energy transition. “Of the €20 billion, €8 billion will be financed through [bringing forward] Member States’ auctioning of emission allowances and €12 billion from the resources of the Innovation Fund,” the Commission said in a statement. The Innovation Fund finances projects that develop innovative technologies designed to reduce emissions.

The total number of EUAs expected to be sold to finance the REPowerEU initiative is estimated to be around 250 million, depending on the EUA price. The regulations covering the Innovation Fund currently allow for only 40 million EUAs to be sold in 2023, and this total is already committed to the existing auction schedule. The regulations need to be amended to increase this total and “front-load” more of the Fund’s EUAs. Market experts are confident that this process will take no more than three or four months and that Innovation Fund's EUAs will be added to the REPowerEU sales before the additional volume is set to start coming to market.

However, Monday’s announcement took some by surprise and triggered a “relief rally,” which some participants suggested reflected lower-than-expected REPowerEU volumes. But analysts speaking at an industry event were careful to emphasize that more volume will be added and that a total of as many as 56-57 million EUAs could be added to the auction pot in 2023.

The price impact is likely to be limited overall, as the market has anticipated the addition of this volume since the REPowerEU initiative was first proposed last year. Investors took data showing that actively managed investment funds had slashed their long positions in EUAs over the past two weeks as a signal to buy, giving prices a boost.

The Commitment of Traders data published on Wednesday showed that all funds had cut their net long positions from more than 20 million EUAs two weeks ago to 4.5 million allowances as of March 24. Typically, traders view fund positioning as a key indicator of the market’s direction, selling when net long positions peak and buying when short positions grow. Excluding the share of EUA futures held by exchange-traded funds, actively managed funds were estimated to hold a net short position of around 3.5 million EUAs last Friday, the largest net short in two months.

At the end of January, the last time funds were net short, EUA price embarked on a more than three-week rally that saw the market rise from €89.23 to top €100 for the first time on February 21. Since then, the December 2023 futures contract has breached €100 on two further occasions before falling to a low of €84.75 on March 20. In view of the relationship between fund positioning and market direction, prices could be about to embark on another rally.

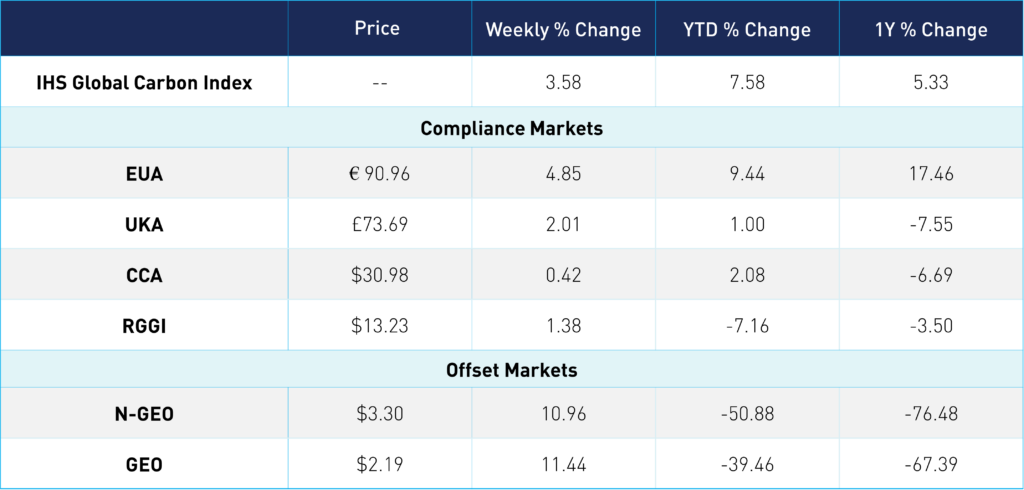

Carbon Market Roundup

EUAs trended up throughout the week, up 4.85% at €90.96. UKAs also had a solid week, up 2.01% at £73.69. US markets saw less price movement, though both CCAs and RGGI ended up for the week, up 0.42% and 1.38%. The offsets futures were in the green, both up roughly 11%, with N-GEOs closing at $3.30 and GEOs at $2.19.