A Look at the Global Expansion of Carbon Markets

4 Min. Read Time

Note on today's carbon sell-off: The global carbon index is down roughly 4.8% today, with EUAs falling by 5.6%. It's important to note that this price action is still within a normal range for carbon, as these markets can be more volatile. That said, with today's continued bank risk contagion, all risk assets have taken a hit. Although carbon is non-correlated to other asset classes, we are seeing direction affected by tightening liquidity. We remain with high conviction that carbon prices will continue to have an asymmetric risk profile over time.

Growth of Carbon Markets Worldwide

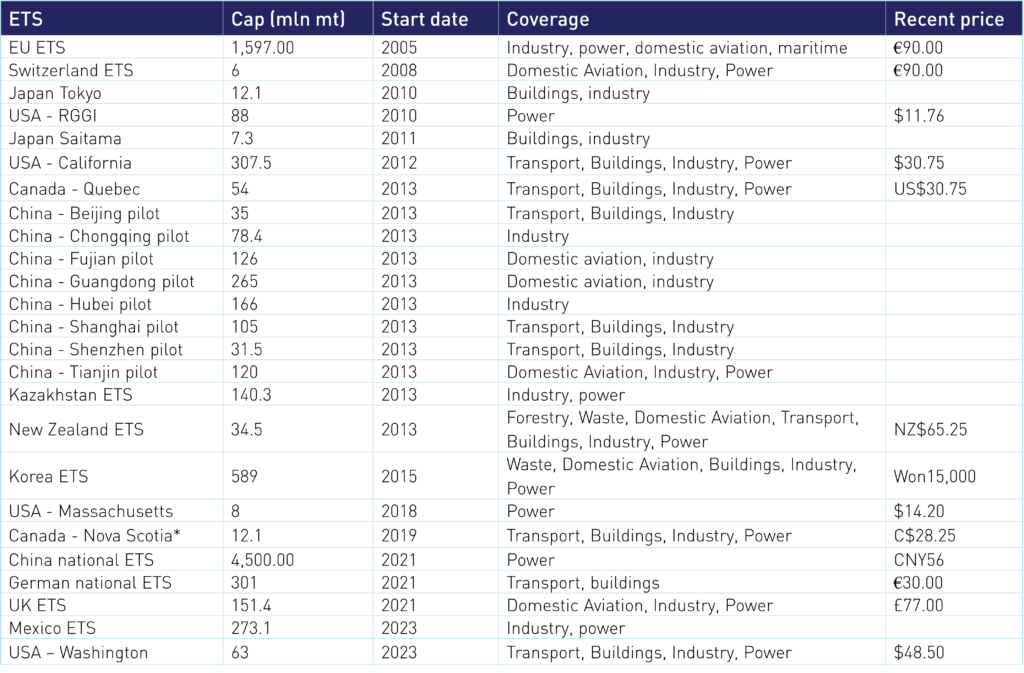

Carbon markets continue their steady growth worldwide, with the launch of two new emissions trading systems (ETSs) in 2023 - Mexico and Washington state - with the promise of more to come.

These new ETSs bring the total number of active markets to 26, covering 9 billion tonnes of CO2 equivalent, compared to 3.8 billion tonnes before markets in China, the UK, Germany, and Mexico began in 2021-23. They represent the latest in what may become a wave of climate market mechanisms as countries knuckle down to the work of meeting their UN-mandated Nationally Determined Contributions (NDCs).

Countries will meet in Dubai this December to carry out the first Global Stocktake of progress toward the Paris Agreement goal of achieving net zero emissions by the middle of the century. The majority of the 194 signatory nations to the Paris treaty indicate that they want to use carbon market mechanisms to help achieve ambitious climate targets.

While many developing countries choose to participate in carbon credit trading systems to attract finance and low-carbon technology, many others – including the most advanced economies – are addressing their emissions by regulating how much carbon their economies may emit.

Cap-and-trade markets to address climate change first emerged in 2005 with the launch of the EU ETS, taking their inspiration from the US sulfur dioxide cap-and-trade market. Carbon markets are rapidly gaining currency as the most efficient way to identify and exploit lowest-cost emissions reductions and put the planet on a path to zero-carbon energy.

The International Carbon Action Partnership (ICAP), a coalition of governments and public authorities that supports the development of carbon markets, lists 26 currently operating compliance markets ranging from China’s Fujian province to Washington state. The organization identifies a further nine currently under development in countries ranging from Colombia to Indonesia, while 14 more countries, including Brazil and Pakistan, are considering markets of their own.

While the scope of these markets differs vastly, ranging from the economy-wide coverage in California to the power sector only in China, the goal is the same – to put a price on the discharge of greenhouse gases into the atmosphere and uncover the lowest-cost reductions.

The various ETSs also employ radically different strategies to achieve their goals. Many markets, such as the EU ETS, employ a combination of free allocation of permits and auctions to distribute allowances to their covered sectors. Free allocation allows the industry to offset the potential cost of carbon permits and remain competitive against international competitors from countries that do not have a carbon price. However, the emergence of carbon border adjustment mechanisms in regions such as the EU will lead to the steady removal of free allocation, forcing more industrials to internalize their cost of carbon and driving greater demand in traded carbon markets.

Some newer markets prefer to limit carbon intensity rather than set an absolute cap on greenhouse gases. For example, China’s emissions trading system (CETS) is the world’s largest compliance market regarding emissions covered. The CETS only covers the country’s power sector at present and sets a cap on the carbon intensity of power generation rather than an absolute limit on emissions. Effectively it aims to improve the energy efficiency of existing operators in the first instance before evolving into a cap-and-trade system later on. Future iterations of China’s market will see an absolute cap introduced, as well as the extension of the market to new sectors such as chemicals, cement, and steel.

Crucially, some carbon markets also have a wide variety of rules governing investors’ activity. Korea’s ETS, for example, presently allows just five government-approved financials to participate in the market, while the EU ETS is open to any non-compliance institution that can meet financial qualifications and has a registry account. Meanwhile, China’s ETS is presently open only to compliance entities, though stakeholders believe participation will be opened wider in future stages.

Some markets also have limits on the volume of positions that individual entities can hold. California’s cap-and-trade market, for example, set a limit in 2023 of 10.5 million permits for any entity or group of entities belonging to the same corporate association.

In addition to the 26 active markets, new ETSs are in the works in countries ranging from Colombia to Vietnam, while nations including Brazil, Malaysia, and the Philippines are also considering launching carbon markets.

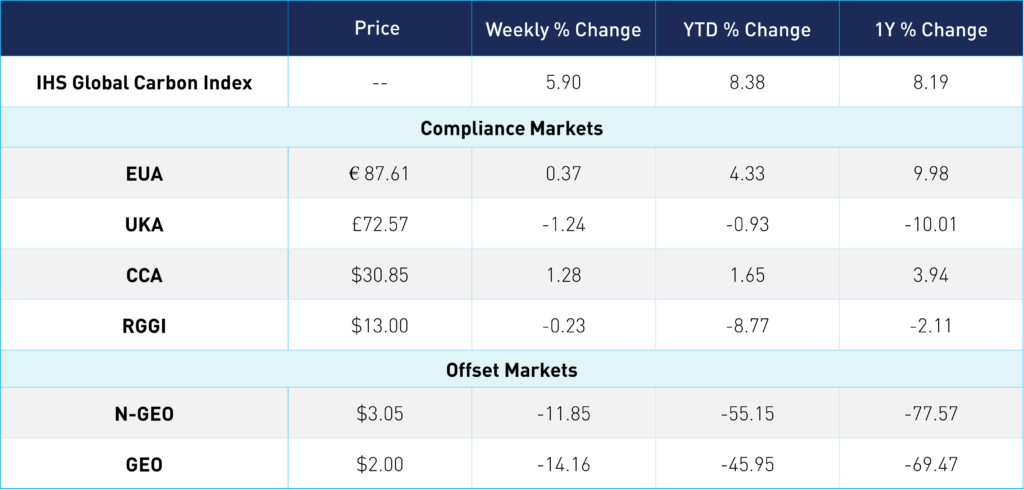

Carbon Market Roundup

After a fairly solid week, EUAs fell sharply today, down 5.6% over the course of the day. On Thursday, EUA prices climbed up over the €90 level to €92.58 and even opened higher today to reach €94.14 this morning. However, risk-off sentiment following the Deutsche Bank news caused a reversal in the EU market, with prices moving down to close at €87.61. Overall EUAs are up 0.34% for the week. UKAs followed a similar trajectory to the EU market, down 1.24% for the week at £72.57. US markets have largely withstood the general market volatility fairly well, with CCAs up 1.24% and RGGI down just 0.23%. The offsets market saw larger losses this week, with N-GEOs down 11.85% and GEOs down 14.16%.