Washington State Launches Carbon Cap-and-Invest Market, California Auction Sells Out

2 Min. Read Time

The state of Washington held its first carbon allowance auction on Tuesday, a key milestone for what is now the third compliance carbon allowance market in the US. The sale, the first of four quarterly auctions scheduled for 2023, offered 6.12 million allowances with a reserve price of $22.20/tonne. The full auction results will be published on March 7.

Washington's market covers approximately 75% of the state's greenhouse gas emissions, including sectors such as fuel supplies, utilities, and waste-to-energy units that emit more than 25,000 tonnes a year. The aviation sector is exempt, as it's covered under country-wide participation in the global CORSIA aviation system.

In 2020, the state's total emissions were approximately 90 million tonnes. The new carbon program has set a target to cut the total to just over 50 million tonnes by 2030, 27 million tonnes by 2040, and 4.5 million by 2050.

Emissions-intensive, trade-exposed (EITE) industries will benefit from the free allocation of allowances, a standard procedure in most compliance markets. The free allocation is based on average emissions between 2015 and 2019, and most EITE plants will receive 100% of these emissions free of charge until 2027. The free allocation declines by 3% from 2027 and 6% from 2031.

Gas-fired power plants will receive 93% of their historical emissions as free permits this year, but that handout will shrink by 7% annually until 2030.

The Washington market will allow companies to use carbon offsets to cover a maximum of 5% of their emissions each year. This limit will decline to 4% from 2027. Entities may also use a further 3% in offsets generated on federally-recognized native land.

Washington agreed to link its market to the neighboring Californian market under the Western Climate Initiative (WCI), which will increase economies of scale and expose the Washington market to a more liquid and transparent system. However, Washington will have to wait until the start of the next compliance cycle to start to join the WCI auctions.

Secondary market trading is just beginning, with just one December 2023 futures trade recorded late last year on Nodal Exchange at $43/tonne. The Intercontinental Exchange (ICE) is set to launch its own derivatives suite later this month.

In neighboring California, the first auction of the new year took place on February 15. At the auction, 56 million current-vintage permits cleared at $27.85/tonne, a premium of $5.64 to the reserve price and $1.05 above the previous sale in November. The forward vintage sale offered 7.6 million allowances, all of which sold out at $27.01, a premium of 18% to the reserve price.

This is the tenth successive time the auction sold out– just two auctions have seen demand less than 100% since 2017. Last month's auction saw the strongest demand since August 2021, with the total volume of bids representing 1.84 times the amount on offer in the current vintage, while the forward vintage sale garnered bids totaling 2.43 times the sale volume.

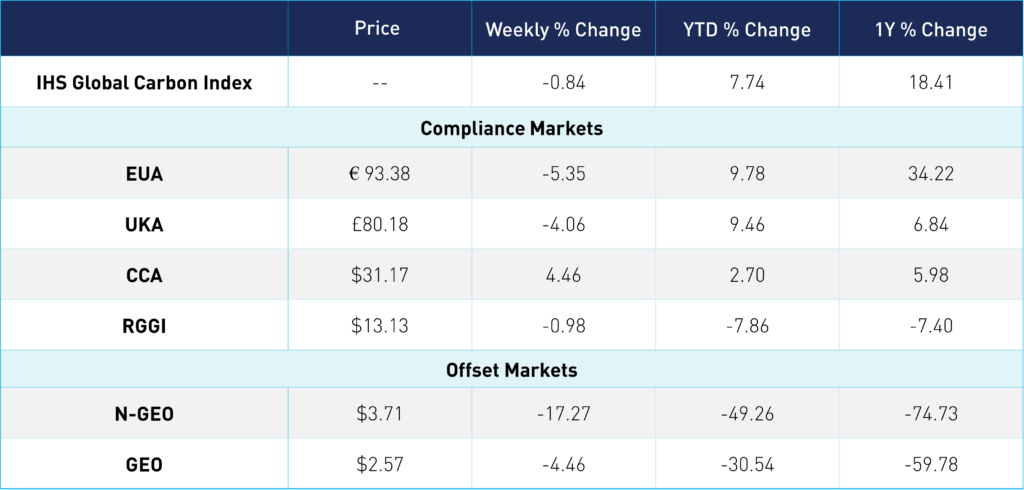

Carbon Market Roundup

EUA prices fell 5.4% over the week to €93.38, the lowest in 2 weeks. EUA started the week off strong, up nearly 3% on Monday at €100.23 but prices weakened then after following steady selling activity. UKAs also fell throughout the week, down 4.06% at £80.18. For the first time in a while, CCA prices broke above the $29 level, up 4.46% for the week at $31.17. Meanwhile, RGGI prices continued to trade in a narrow range, closing at $13.13. As for the offset market, N-GEOs fell sharply throughout the week to $3.71. GEOs saw slight losses and closed at $2.57.