EUA Prices Break Above €100 Level

3 Min. Read Time

EU carbon allowances finally broke above the €100 barrier this week, driven by expectations of a recovery in industrial output and a stronger economic outlook.

This price action marks an important milestone as it's taken 18 years to reach this critical psychological level. Last August, EUAs flirted with €100 level but then quickly retreated down to a low of €69. However, this time around it looks like EUAs could maintain these levels. In the past, the market endured structural oversupply, financial crises, and violent swings triggered by macroeconomic events. Just last year, the market was tested by the Russian invasion of Ukraine and an ongoing energy crisis. Nevertheless, EUAs have proven resilient, and with much of the main geopolitical and economic tests behind us, EUAs are in a better position to remain at these higher levels. It's important to note that maintaining these levels is key to furthering decarbonization efforts, as higher prices will likely lead to greater investment in low-carbon innovation to help Europe reach its 55% emissions reduction target by 2030.

Europe has set the global pace in climate ambition. EU institutions are finalizing the approval of the bloc's "Fit for 55" reform package, which will reduce the EU ETS cap on emissions, steepen the annual cut in the number of allowances issued, and bring new sectors of the economy into the cap-and-trade market.

The reforms mean a growing scarcity in the supply of EU emissions Allowances (EUAs). The Fit for 55 package foresees a one-off cut of 117 million EUAs in the market's annual cap by 2026 and an increase in the annual reduction of the cap from 2.4% to 4.4%.

Additionally, the EU ETS is expanding to cover the maritime sector, limiting emissions from intra-EU voyages and requiring ship operators to buy EUAs to cover their greenhouse gas emissions. Shippers will be gradually brought into the system from 2024 to 2026, and their demand will feed into the market over that period.

More importantly, the EU is introducing a Carbon Border Adjustment Mechanism (CBAM), under which importers of selected products will need to buy EUA-linked certificates covering the carbon content of the products. This new tariff policy is key to leveling the playing field for EU nations by addressing the issue of carbon leakage. Previously, companies in countries without carbon markets could have a slight competitive advantage because they weren't paying for the added cost of their carbon emissions, but with CBAM they'll now have to account for this added cost. CBAM will also enable market regulators to end the practice of handing out EUAs free of charge to EU-based industrials. In past years, industrials have been allocated a certain number of free allowances based on their reported emissions. Phasing this policy out could boost demand for EUAs in the secondary market and tighten the market even further.

What's particularly notable about these reforms is that they have been approved against a backdrop of the energy crisis and economic downturn, when the political direction would usually be expected to be more cautious.

The industrial output is likely to have dropped in 2022 amid soaring energy costs, affecting demand for EUAs from sectors ranging from glass to chemicals. Still, the macroeconomic signals are already showing a revival in the region's economy, bringing renewed demand for EUAs.

The energy crisis led to a reversal in the region's shift away from coal, driving increased demand for EUAs as carbon-intensive coal units were brought back online. This trend will likely offset the fall in industrial demand for EUAs in 2022, market sources believe, and may persist deep into 2023 as the region focuses on protecting its gas stocks and supplies ahead of winter 2023-2024.

In the longer term, the advent of EUA prices at €100 should also make developing new abatement technologies more practical. For example, advocates of carbon capture and storage have long identified €100/tonne as a key level that would bring the technology within economic reach. At the same time, the European Commission has also said that carbon prices of around €70-€90 are needed to support the development of green hydrogen in industrial processes.

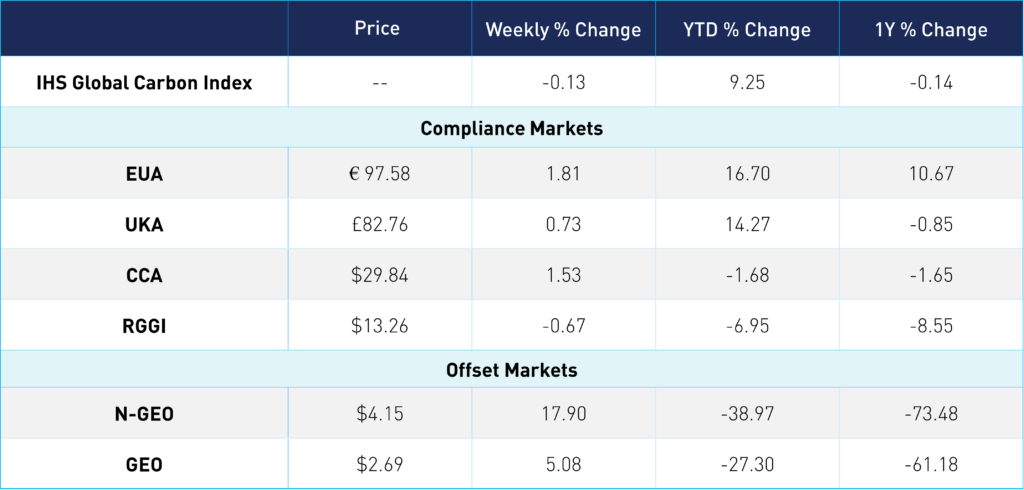

Carbon Market Roundup

EUAs started the week up, at €98.35, then climbed even higher Tuesday to €100.34. Prices then moved down slightly Wednesday but regained losses throughout the week to end at €97.58. UKAs closed at £82.76, up 0.73% for the week. UKAs saw a 3.2% drop on Wednesday from their high of £85.41 but moved higher towards the end of the week. Both CCAs and RGGI prices traded in a narrow range of $29 and $13, respectively, remaining fairly unchanged from the week prior. N-GEOs moved back up above $4 mid-week to close at $4.15. Meanwhile, GEOs were up 5.08% at $2.69.