New York Economy-wide Carbon Market in the Works

2 Min. Read Time

Exciting new climate developments are taking shape in New York following Governor Kathy Hochul's recent announcement on the launch of an economy-wide 'cap and invest' carbon program for the state. Currently, New York's power sector emissions are regulated under the Regional Greenhouse Gas Initiative (RGGI), which is a carbon emissions trading system that exclusively covers the power sector across 11 Northeast/Mid-Atlantic states.

State regulators in New York have been instructed to develop an economy-wide carbon market to help achieve a 40% cut in greenhouse gas emissions by 2030 and an 85% reduction by 2050, as laid down in the Climate Leadership and Community Protection Act (CLCPA). To reach these targets, the program would set a limit of nearly 20 million metric tonnes of CO2 emissions for 2030, compared to the 335 million mt reported in 2019.

The proposed carbon market is the key outcome of the Scoping Plan produced late last year by the state-wide Climate Action Council, which recommended a so-called “cap-and-invest” model. With this model, revenues from the auctioning of emissions permits are used to support policies and programs that further reduce emissions, such as public transportation, electric vehicle tax credits, and charging infrastructure.

Regulators at the state’s Department of Environmental Conservation and the State Energy Research and Development Authority will begin crafting rules that will determine whether the power sector will continue to operate within RGGI or transition into the new state-wide market.

The CLPCA requires state authorities to complete the rule-making for the market by the beginning of 2024, but it’s unclear whether the market will also start by that date.

With the recent launch of the Washington state cap-and-invest market, New York regulators may consider linking its new market to existing economy-wide systems on the west coast. Washington state regulators are also expected to decide later this year on whether to join the Western Climate Initiative (WCI), which groups California with Quebec in a joint market.

Since RGGI only covers one industrial sector, there has never been a strong likelihood of a link to the WCI market, but the scope of both New York and Washington’s markets are seen as more suited to linkage.

Carbon Market Roundup

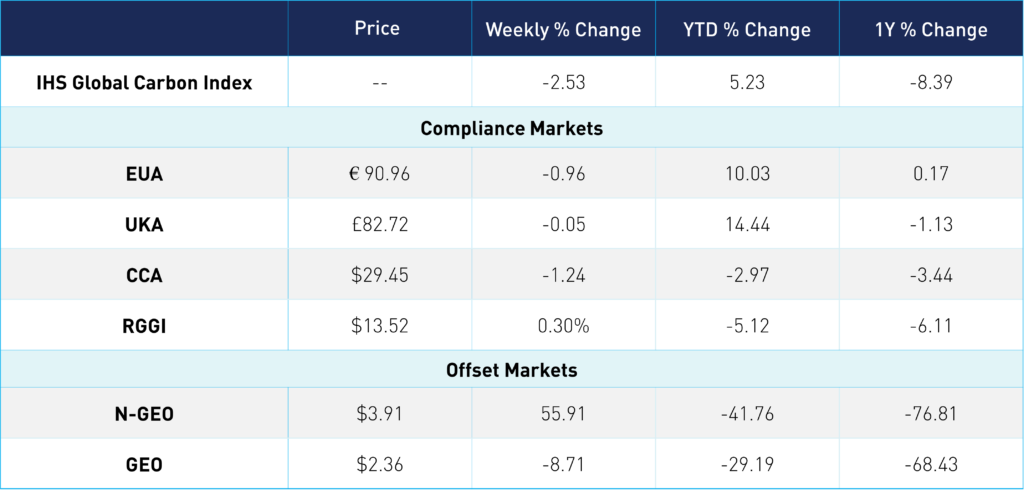

EUA prices dropped roughly 3% Monday but remained steady just above the €90 level in the following days. This week, the EU Council (member states) and Parliament's environmental committee (ENVI) both officially voted on the ETS reform package, which was finalized through a provisional deal in December. The market was anticipating these meetings, though approval from both groups was expected, and most of the reform provisions have already been priced into the market. The next step for the package is a formal vote by the full EU Parliament, scheduled in April. UKAs also saw a slight dip Monday, down 4%, though regained ground throughout the week to end at £82.72. As for the US markets, both CCAs and RGGI traded in a narrow range, with prices remaining unchanged at $29 and $13, respectively. N-GEOs had a comeback, with prices sharply climbing throughout the week to end at $3.91. GEOs, on the other hand, fell slightly, closing at $2.36.