Trove Research Releases Strong 2030 Voluntary Carbon Outlook

3 Min. Read Time

The primary market for voluntary carbon credits could increase in value by 20% to around $1.9 billion in 2023, assuming prices and demand continue to increase at recent rates, according to Trove Research.

After a 30% increase in value from 2021 to 2022, expectations for the voluntary carbon market (VCM) in 2023 range between $1.3 billion and $1.9 billion, Guy Turner, founder and CEO of the firm, as stated during a webinar their week.

Prices are forecast to increase up to 25% this year, while the volume of retirements could grow up to 15%.

The number of companies setting Science Based Target Initiative-endorsed emission reduction goals reached a new peak of 4,253 at the end of 2022, including blue-chip names such as Sony, DHL, Lufthansa, Delta Airlines, and Cemex, Trove analysts noted.

The supply of carbon offsets fell 14% in 2022 to 325 million tonnes, Trove found, due largely to moratoria on the sale of credits from Indonesia, Papua New Guinea, and Honduras. These countries have been significant sellers of carbon offsets from REDD+ in previous years, and the overall volume of REDD+ credits issued dropped by around one-third last year as a result.

Nonetheless, around 40% of last year’s total supply was for offsets generated by nature-based solutions such as REDD+ and nature restoration, while renewable energy offsets made up a similar share. These offset types correspond broadly to the N-GEO and GEO derivative contracts operated by exchanges CBL and CME.

DEMAND/ RETIREMENTS

Credit retirements in 2022 totaled 173 million tonnes, an increase of 2% from the previous year, despite global macroeconomic headwinds stemming from Russia’s invasion of Ukraine and the energy crisis.

Nature-based credits represented around a third of all retirements in 2022, but were overtaken by renewable energy, which accounted for nearly half of all the credits retired.

The drop in nature-based retirements was due in part to the moratorium from three of the larger REDD+ producing countries, while price may also have played a role.

A key feature of credit retirements in 2022 was that corporates chose to retire much “younger” credits than in previous years, according to Trove research.

“Generally, you might expect that the average vintage year of retired credits would increase by one year, every year,” company analysts said. “However, last year, the average retired credit vintage year increased by about three years, from 2015 to 2018.”

In 2022, high-tech and permanent removals were one of the fastest-growing sectors in demand. Technologies such as direct air capture, biochar, and mineralization are moving toward large-scale deployment. While purchases from these project types totaled just 590,000 tonnes in 2022, this was a five-fold increase over 2021.

“We should expect to see more pockets of those kinds of highly desirable projects coming to the fore," Trove founder Guy Turner said, highlighting the growing demand for “blue carbon” offsets generated by projects based in coastal and ocean ecosystems.

The global surplus of unretired carbon credits grew by 27% to 751 million tonnes, including around 150 million tonnes of offsets from older vintage projects regarded as less desirable by corporate buyers.

Critically, the volume of potential future offsets from projects that have not yet been approved more than doubled last year, from 200 million to 529 million tonnes.

“This massive increase in capacity points to a growing investment in carbon projects,” Trove said, though it cautioned that these projects may not all eventually be completed.

PRICE

The average weighted price for all transacted credits in 2022 was $8.80/tonne, up 40% from 2021’s average of $6.30, according to Trove research.

However, this masked a decline in prices in the second half of 2022, as the market slumped amid the conflict in Ukraine. The weighted average price ended 2022 15% lower than where it started, the analysis found.

The strength of the US dollar also meant that the price decline for transactions in other currencies was far less marked, Trove said. Euro-denominated prices ended the year down 10%, while sterling prices were just 5% lower.

Average weighted prices for CBL NGEO-eligible credits fell from just under $14/tonne in Q4 2021 to $4.00/tonne at the end of Q4 2022, while the weighted average for GEO transactions fell from nearly $8/tonne to $2.90 across the year.

A poll of more than 300 market participants on price expectations for this year, taken during the webinar, found that renewable energy credits are expected to end the year trading uncharged between $3-$6/tonne. Clean cookstove credits were forecast to reach $7-$10, REDD+ at $11-$14, and nature restoration between $15-$18/tonne.

Carbon Market Roundup

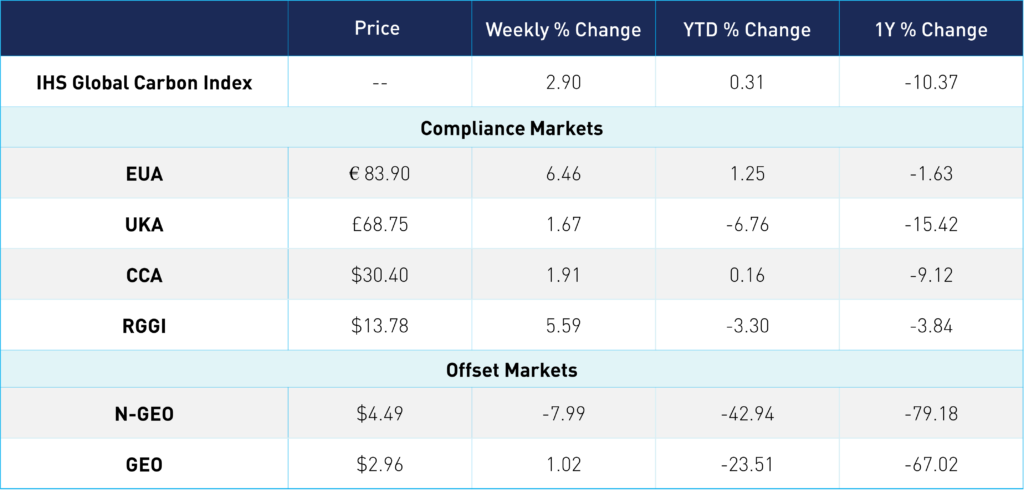

EUAs and UKAs were both up for the week, +6.46% and 1.67%, respectively. On Wednesday, EUA prices jumped 4.6% from the day prior, while UKAs had a more steady increase. CCAs moved back up above $30 at the end of last week and maintained a mid-$30 range into this week. RGGI also saw a steady increase over the week, up 5.59%. N-GEOs prices fell on Tuesday but saw a slight recovery Wednesday back at the mid $4 range. GEOs traded within a narrow range, ending just below $3.