A Year in Review: Tracking Carbon Price Highs & Lows in 2022 and Major Policy Shifts to Watch for in 2023

2 Min. Read Time

CA and RGGI

At the start of 2022, California Cap-and-trade began trading at $34.60 before the Ukraine-Russia conflict plummeted the prices to $24 in March. The market rebounded to $32 in April and since has declined as the FED increased interest rates and recession risk increased. The CCA’s price closed the year at $30.34.

The RGGI prices started trading in 2022 at $14.12, higher than the Cost-Containment reserve for the year. There was a sharp correction in March, with prices dropping to $12.50, then a rebound in April to $14.20, to end the year at $14.26.

For the Cap-and-trade systems, 2023 is well positioned for a monumental year. Beginning in January, Washington will start its Cap-and-trade and Low Fuel Standard program, and the California and RGGI programs will undergo reviews.

The program reviews in California are expected to sharply tighten the market from a target of 40% below 1990s levels by 2030 to a more ambitious target of 55% below ’90s levels. This tightening will reduce future allowances auctions and account for the bank of allowances in the market. The California Air Resources Board (CARB) will likely release the new regulations by the end of 2023. This anticipated move is expected to spur investor momentum in carbon markets.

The RGGI third program review will be released in the fall of 2023. The tumultuous RGGI journey for both Pennsylvania and Virginia will likely be settled in the states’ courts in 2023, and the resolution of the issue may bring stability to the market.

The EU’s cross-border mechanism (CBAM) will start its introductory phase in October 2023. In its initial phase, importers will have to report emissions embedded in their goods. The carbon charge on imports into the EU will spur global carbon markets. It may also incentivize the US Federal Government to plan out a national carbon market.

EU and UK

EUAs began 2022 trading at €84.01 and then rose to above €96 during multiple sessions in February before dropping to a year low of €58 in March as the market reacted to the Russia-Ukraine war news. The prices then rose to a high of €98.01 in Mid-August as decreased gas flow from Russia exacerbated electricity prices. The EUAs closed the year at €83.97.

UKA to EUA premium continued through most of the last year and was maximum during August when the electricity prices skyrocketed, reaching a high of £97.75. UKAs began 2022 trading at £74.60 and closed with a reversal trend as EUAs traded $9.05 higher than UKAs on 14th Dec. The UKAs closed the year at £73.25.

Both EUR and GBP weakened last year. EUR decreased about 6.24%, while GBP saw a fall of 10.87% compared to the US Dollar.

EUAs saw a volatile end to 2022, as European legislators agreed on multiple initiatives that will radically shape Europe’s climate policies in the coming years:

- EU reached a final agreement on the proposed “Fit for 55” proposals.

- The GHG reduction target was increased to 62% from 2005 levels by 2030, from 43% below 2005 levels.

- There will be a one-off reduction to the EU-wide quantity of allowances of 90 Mt Co2 equivalents in 2024 and 27 Mt in 2026.

- Emissions from Maritime are now covered under ETS and will be phased in from 2024 with the full scope in 2026.

- The linear reduction factor of allowances will be 4.3% from 2024-27 and 4.4% from 2028-30.

- The phase-out of free allowances to industries in the ETS and the phase-in of CBAM will start in 2026 and be completed by 2034.

- A new ETS II for fuel for road transport and buildings will be established by 2027.

- EU member states agreed on a $60/barrel cap on Russian oil.

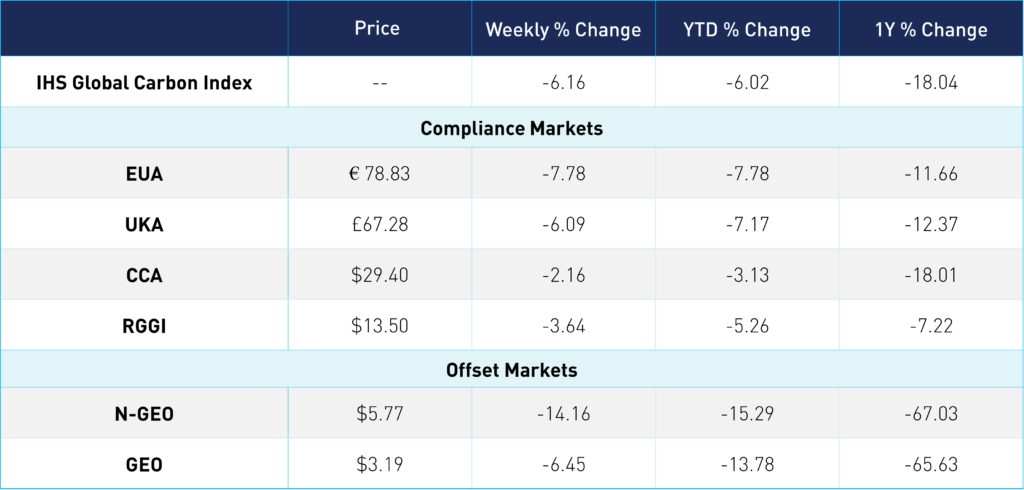

Carbon Market Roundup

EUAs and UKAs trended down this week, -7.78% and -6.09%, respectively. Warmer than normal winter weather has impacted energy demand, and in turn, market sentiment. Warmer weather means less burning fuel to heat homes, which reduces demand for allowances. US markets were also down for the week, with CCAs down -2.16%, dipping just below $30 mid-week. RGGI was down -4.64%, ending at $13.50. N-GEOs ended at $5.77, while GEOs were $3.19.