EU Market December Wrap-Up

2 Min. Read Time

In the early hours of Sunday morning, EU legislators, member states, and the Commission reached a deal on the “Fit for 55” carbon market reform package, as well as a raft of other initiatives that will radically change Europe’s climate policies in the coming years.

In brief, the co-legislators agreed on the following:

- Reforms to the EU ETS

- Creation of a new carbon market covering emissions from domestic heating and transport fuels (ETS2)

- The creation of the Carbon Border Adjustment Mechanism (CBAM)

- The sale of EUAs to fund the REPowerEU initiative

A more detailed description of the key policy developments can be found in our previous blog here.

The Fit for 55 package has been in the legislative process since the summer of 2020, and forms part of the EU’s more expansive Green Climate Deal, a root-and-branch reform designed to make the bloc’s economy more sustainable and climate-friendly.

Market stakeholders have welcomed the package of reforms and new initiatives, noting that the European Union has stuck to its guns on climate ambition, despite the challenging macroeconomic conditions and the energy crisis.

The December 2022 EUA futures contract expired on December 19 at €84.11, an increase of just over 4% year-to-date. The December 2023 futures contract, which now takes over as the benchmark, is currently trading just below €90.

The daily EUA auctions also came to an end this Monday, completing the sale of more than 482 million EUAs to the market. Compliance and speculative traders will have to wait until January 9 before supply resumes with the start of the 2023 schedule. The suspension of auctions for three weeks is generally viewed as fundamentally bullish for prices.

The outlook is made even more bullish by the combination of tight natural gas supplies, which increases the call on coal and therefore boosts emissions, and relatively low French nuclear generation – which boosts demand for German coal-fired power.

Energy traders caution that gas storage levels in the EU are presently comfortable, which may mitigate against a further rise in gas prices. Still, demand remains strong for both gas and power amid the recent cold snap.

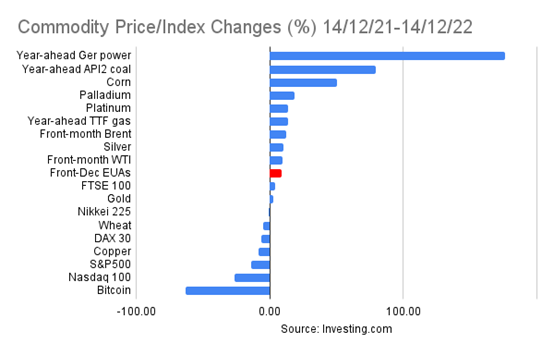

Carbon has been a stable asset over the course of the year, compared to other major commodities and equity indices, as seen in the chart below.

Traders have underlined that EU climate ambition fundamentally underpins this market and has made it far more resilient to macro volatility than other asset classes.

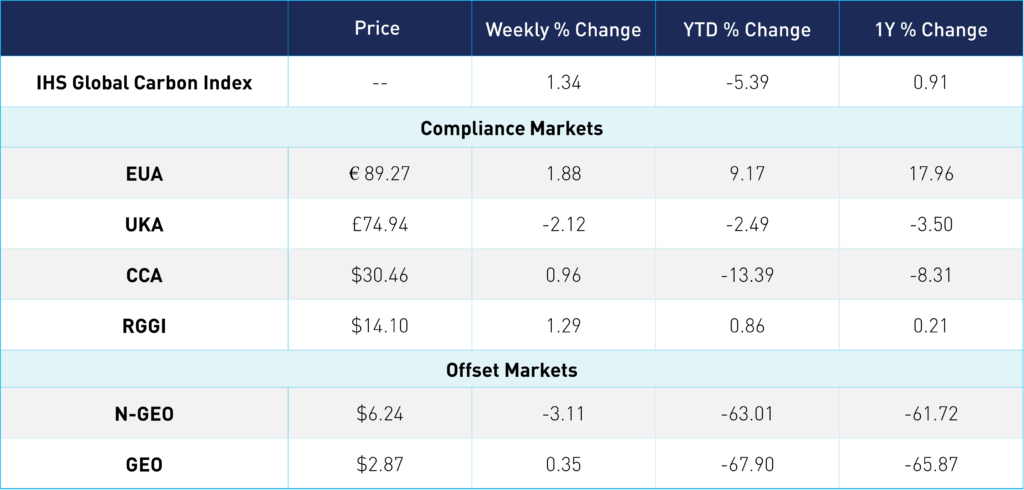

Carbon Market Roundup

This week reflects the switch to December 2023 futures contracts. EUAs trended up for the week, ending at €89.27, while UKEs were relatively flat and mostly remained at the ₤74 level. US markets mostly traded within a narrow range for the week. CCAs were up 0.96% to $30.46, and RGGI was up nearly 1.30% to $14.10. Nature-based offsets (N-GEOs) started the week off just below $6 but trended up throughout the week to end at 6.24. GEOs stayed within the high $2 range.