Year-end Look at EUAs

2 Min. Read Time

European carbon prices have risen by more than 20% in the past two weeks, heading back toward €90/tonne as the market is preparing for the end of the 2022 auction program, the expiry of options and futures contracts, and the onset of colder weather.

The current benchmark December 2022 futures contract expires on December 19, and the bulk of EUA trading will shift to the Dec. 2023 contract, which is presently trading around €3.60 higher than the Dec. 2022 contract. The annual expiry of the front-December contract is accompanied by a significant amount of ‘rolling’ positions, as traders swap positions to maintain their exposure.

Most of the current open interest of around 340 million tonnes in the Dec. 2022 contract will shift to the Dec. 2023. Still, a significant portion is also likely to be delivered into physical EUAs or transferred into March 2023 futures contracts, ahead of the 2022 compliance cycle that will end in April next year.

The daily EU Allowance (EUA) auctions end on December 19, completing the sale of more than 482 million EUAs to the market. Compliance and speculative traders will have to wait until January 9 before supply resumes with the start of the 2023 schedule. The lack of new supply for three weeks is expected to be strongly supportive for the market.

Before this, however, the December 2022 EUA options contract expires on December 14, and positioning ahead of this date will likely influence EUA prices.

ICE data show that the call option strike prices with the most open interest are mainly at prices higher than the underlying futures market’s current levels:

The high open interest at a €90 strike price is likely to act as a magnet for futures prices in the remaining weeks before expiry, and higher prices are less likely in the short term.

The onset of colder weather in Europe has also boosted sentiment in the market. The relatively mild temperatures seen deep into November depressed winter heating demand and, therefore, also damped potential demand for EUAs to cover rising thermal power and heating generation.

However, a colder weather pattern has developed over the region, supporting natural gas and coal prices over the coming month. January TTF natural gas prices have rallied steadily since dropping close to €100/MWh in mid-November and are now at more than €138/MWh, as rising demand is beginning to eat into storage levels.

Similarly, coal prices have also leaped nearly 60% since mid-November, with the calendar 2023 futures contract spiking from $180/tonne to $280/tonne.

Calendar 2023 German baseload power has climbed by only 20% over the same period, tightening the profit margins for utilities. However, with natural gas prices still far out of the money for power generation, the electricity sector remains wedded to coal, which translates into continued strong demand for EUAs.

The technical outlook for EUA prices is also bullish. The market bounced off the 50-day moving average on November 11, the same day that gas, coal, and power prices began to recover. The continuing rally has seen EUA prices rise above the 20-day, 100-day, and 200-day averages.

After prices climbed above a key Fibonacci level at €85.80 last week, there remains a succession of short-term technical price targets between €88.75 and €94.19 before a rally would open up the existing record high of €99.22.

Politics will likely remain a strong influence until the end of the year. The Czech EU presidency has said it fully intends to complete the negotiations over EU ETS reform as well as the REPowerEU initiative before it hands the reins over to Sweden on January 1.

While the scope of the reforms to the market are well known and largely priced in by now, a successful passage of the “Fit for 55” package may give sentiment a boost.

Carbon Market Roundup

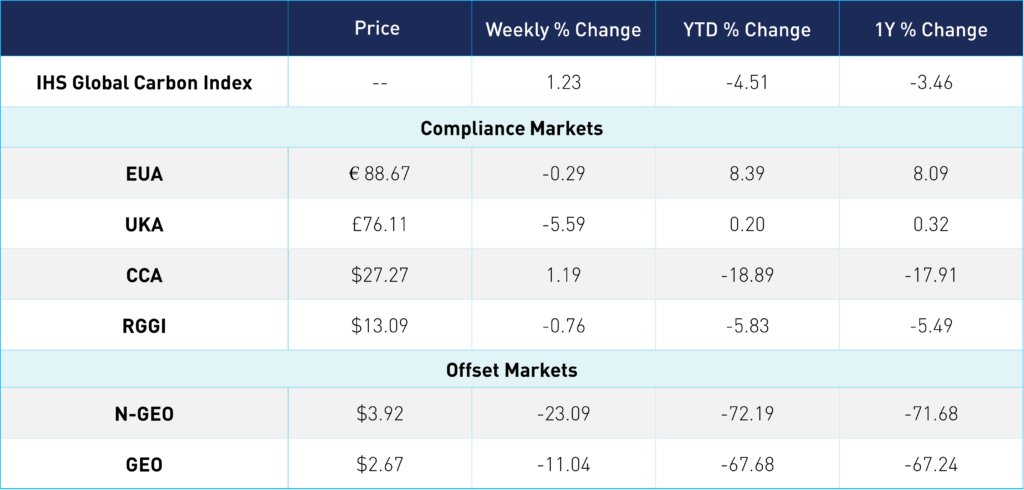

EUAs remained in a narrow range for the week between €87-88. UKAs have been trending down from their high last Friday, down -5.6%. CCAs and RGGI were relatively flat for the week, at $27 and $13, respectively. In the offsets market, N-GEOs began trending down this week, dipping below $4. Meanwhile, GEOs moved down roughly -11% to the mid $2 range.