EUA and CCA Price Action Update

2 Min. Read Time

European carbon prices have slowly rallied to reach a peak of just over €84 at the end of November after falling to a low of €66 in the latter stages of October: a gain of 27% in little over a month.

The market is reacting to intensifying political discussions in Brussels as lawmakers are reaching the climax of their negotiations over reforms to the EU ETS and the Commission’s proposed REPowerEU initiative, which aims to speed up the transition from fossil fuel energy.

The “Fit for 55” program would see a one-off reduction to the cap on emissions, a steeper reduction in the cap each year, and the extension of the market to cover maritime emissions.

REPowerEU would be part-funded by the sale of EUAs, and Brussels stakeholders are debating whether the allowances should be brought forward from member state auctions in later years or from the market stability reserve (MSR). Selling EUAs from the MSR would represent a net addition to short-term supply, which would be bearish for the market.

Negotiations on both “Fit for 55” and REPowerEU are expected to be complete by the end of the year.

The expiry of the December 2022 EUA futures contract on December 19th may bring some volatility with it as traders shift long positions to the next front-December contract. The earlier expiry of options contracts is also expected to drive prices, with large positions currently seen for call options at prices of €80, €90, and especially €100.

Also, there will be a gap in supply over the height of the winter demand as the final sale of the year takes place on December 19, and sales will resume only on January 9 next year. This gap typically drives prices higher, at the same time as the front-December contract expires and is replaced by the succeeding one, which also generates buying pressure.

Meanwhile, Californian prices have fallen from $28.50 to $26.75 over November as traders have begun “rolling” positions in the December 2022 futures contract into later-dated contracts ahead of the expiry of the benchmark contract.

The quarterly auction took place on November 16th and saw all 58 million current-vintage permits sold at $26.80, the lowest clearing price since the Q3 2021 sale, though still a $7.10 premium to the reserve price.

The sale also cleared slightly below the prevailing secondary market price, suggesting that a strong result was not anticipated.

The weak price action in the last month is not seen as adequately reflecting the outcome of the Air Resources Board’s (ARB) work on its 2030 Scoping Plan, in which the regulator has laid out how to meet the state’s 2030 climate goal of a 40% cut in emissions.

ARB has modeled an economy-wide cut of 48% as well as a 2045 goal of an 85% reduction as regulators assume that the cap-and-trade market will have to go beyond its mandated targets to help the state reach its overall goals.

Amendments are expected to the market’s cap to reach the new targets, but the regulators have not made any announcements so far.

Carbon Market Roundup

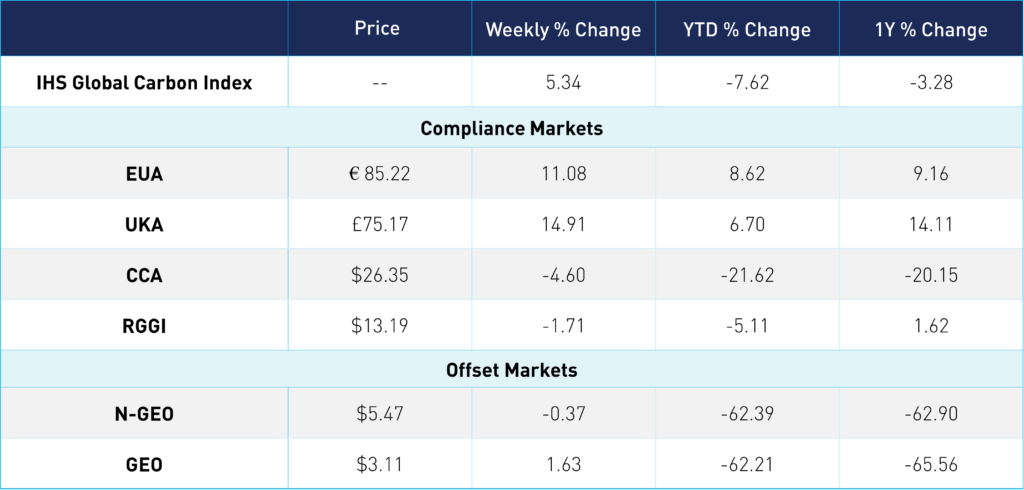

Both EUAs and UKAs pushed higher throughout the week, up 11.08% and 14.91%, respectively. Today, they're climbing even higher, with EUAs at €87 and UKAs at just under £80. As for US markets, CCAs and RGGI trended down slightly for the week. N-GEOs were relatively flat, as were GEOs.