EU ETS Briefing: Carbon Prices Rise While Energy Prices Fall as the Region Boosts Winter Gas Supplies

3 Min. Read Time

European energy prices have dropped sharply from their all-time highs earlier this year. Meanwhile, carbon prices are rising with the prospect of increased demand from power generation during the winter months, outweighing concerns about falling industrial output as macroeconomic headwinds increase.

Natural gas prices at the Dutch Title Transfer facility, the regional benchmark, have fallen by 73% since peaking at more than €350/MWh back in August. Market participants say that the price decline reflects significantly higher gas storage levels, extended warmer-than-normal weather across Europe, and a glut of liquefied natural gas (LNG) supply.

After Russia’s invasion of Ukraine and the interruption of gas supplies to Western Europe through the Nord Stream pipeline, EU member states scrambled to rebuild gas stocks ahead of the coming winter. A massive increase in purchases of LNG, together with pan-EU measures to cut demand, have helped the bloc rebuild storage to around 93% of capacity by mid-October. The Breugel think-tank estimates the EU has cut gas demand by about 7% this year, compared with the average between 2019 and 2021.

EU member states also have fast-tracked plans to enhance and improve the region’s grid network, with France and Spain recently agreeing to upgrade gas pipelines that link the two countries. Meanwhile, Germany is hurrying to establish a fleet of floating LNG terminals off its coast.

Coal prices also reacted sharply to the Russian invasion, with the European benchmark rising from $110/tonne to as much as $350/tonne in September. Since then, the coal price has fallen by 33% to $235/tonne in mid-October.

The spike in gas prices and EU measures to cut demand have largely sidelined natural gas as a fuel for power generation. Governments have drawn up measures to reduce industrial demand if necessary, and numerous member states have imposed restrictions on heating, some setting deadlines into November before large or public buildings can be heated.

Coal plants have been brought back out of reserve to supply the grid. At the same time, the REPowerEU initiative proposed by the European Commission seeks to speed up the deployment of renewable generation to help the region transition away from the Russian energy supply.

The return of coal generation in Europe has supported EU Allowance prices. EUAs dropped from €95 to as low as €55 in the week after the invasion of Ukraine began, before recovering to reach a new all-time high of €99.22 on August 19.

The price of carbon in the EU stabilized and spent much of the last month in the mid-€60s before rallying sharply in the last few days to reach €75 as traders eye the onset of winter and the high-demand season for power generation.

Carbon has been caught between competing forces for several months, with the Commission’s proposal to sell additional EUAs to help fund its REPowerEU plan threatening to depress prices, while increased coal burn and the ongoing discussion over ambitious reforms to the market helping to sustain prices.

Traders have been waiting for news from Brussels about the REPowerEU funding plan. The Commission’s original proposal called for additional allowances to be brought out of the Market Stability Reserve (MSR) and sold to raise €20 billion for the initiative. However, the European Parliament has amended the proposal to specify that there should be no new EUAs injected into the market and that the funding should be raised by simply bringing forward auction volumes already scheduled for sale in later years.

The Parliament is due to formally adopt this position in early November, after which it will begin negotiations with the European Council and Commission over the final shape of the program.

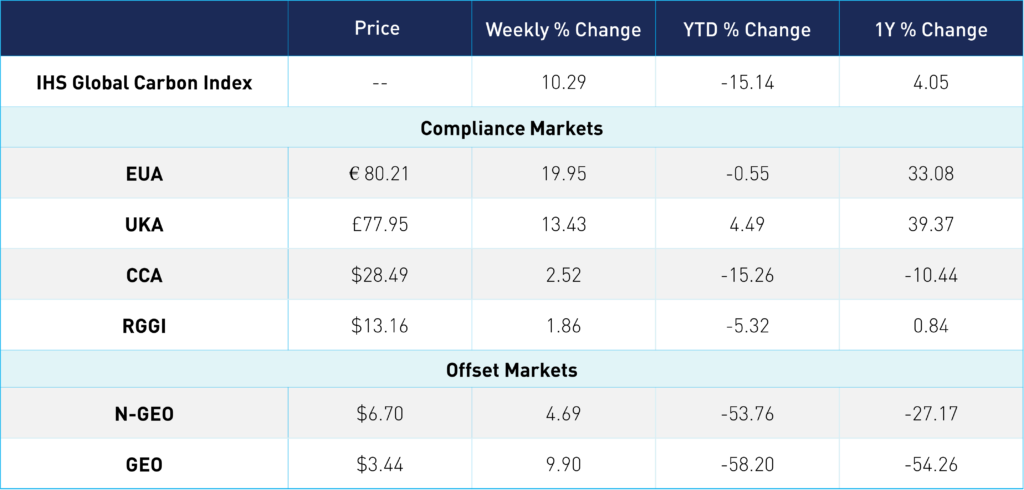

Carbon Market Roundup

EUAs reached a seven-week high, closing just above €80 mark on Thursday. EUAs saw a slight dip Wednesday but, by Thursday, regained losses and posted a nearly 20% jump week-over-week. UKAs had a strong rally as well, steadily increasing over the week. EUA futures closed at £77.95, up +13.4%. In the US, CCAs saw slight gains, +2.52%, while RGGI didn't have much price movement, +1.86% for the week. Offsets had a strong week, N-GEOs +2.69% and GEOs +9.90% week-over-week.

Carbon Futures Prices