EU ETS Reform Gets Teed Up for Next Steps After Council Meeting, CCAs Follow Macro Sentiment

2 Min. Read Time

EU ETS Reform

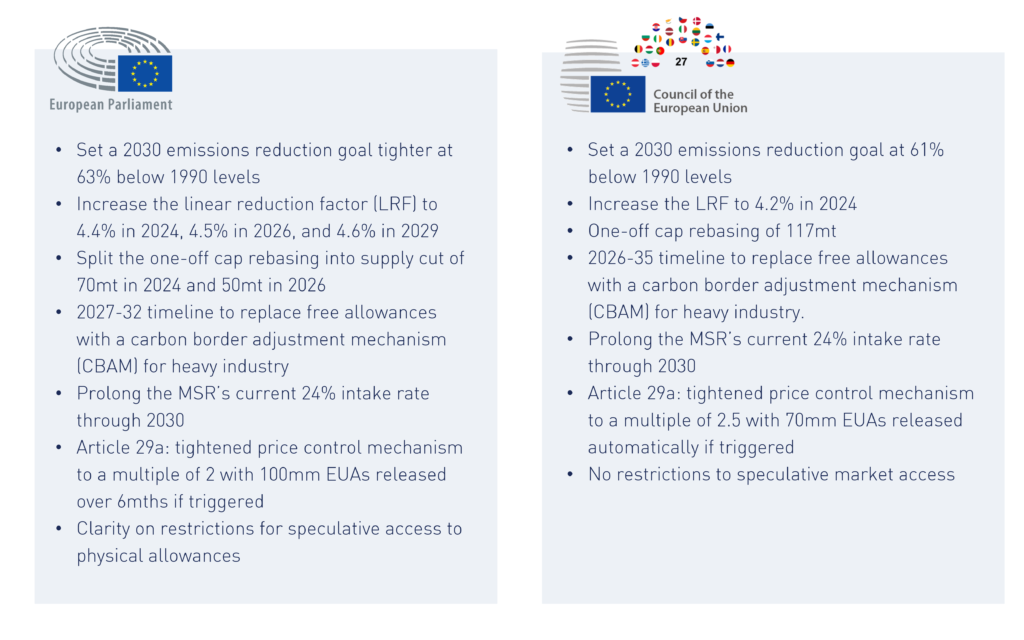

After 16-hour long talks that ran well into Wednesday morning, the 27 EU member states formed a unified stance on how to structure the EU ETS reform. Unlike the European Parliament, the Council mainly adhered to the Commission’s original proposal including the less ambitious 2030 emissions reduction target of 61% below 1990 levels. The ministers disagreed on minor elements of the package, with some differences of opinion heard on the parameters of the Article 29a price control mechanism, while others were more focused on the Social Carbon Fund that is to help defray some of the impact of high energy prices. We outlined below exactly how the Parliament and Council differ in their proposed amendments to the ETS reform.

While the Council left most technical policies untouched, it significantly reduced the size of the Social Climate Fund (SCF)—from the Commission’s proposed €72 billion over 2025-32 to €59 billion through 2027-32. The fund will see contributions from auctions under the new ETS2 for buildings and transport, and its investments are designed to benefit vulnerable households, micro-enterprises or transport users.

With regards to Article 29a, the Council agreed to have 70 million EUAs allowances be released automatically from the market stability reserve (MSR) if, for six months, prices rose more than 2.5 times higher than the preceding two-year average. In comparison, Parliament called for a lower threshold, reducing the price multiple to two as well as having the Commission convene within seven days of being triggered to discuss the market fundamentals, rather than the automatic injection of allowances. In both cases, the new proposals lower the existing threshold, which is currently 3x the average price.

Liberal EU Parliamentarian, Pascal Canfin, noted that the compromise in Parliament “allow[ed] us to vote massively in favor of this climate protection package,” and that European cooperation will be “the only way to win, as an institution and for the climate.”

Next up, both Parliament and the Council will enter negotiations as early as mid-July, where they will ultimately have to come to a unified position on the package. It’s hard to predict what kind of compromise the two legislative bodies will arrive at though considering the opposition faced at Parliament’s hearings, coming to a mutual agreement may not be an easy task. However, at either end of the spectrum, there is a solid slate of tightening measures for the market.

California

California allowances have traded in line with macroeconomic sentiment over the past week, with lower prices seeming to attract some growing interest. CCA prices have fallen by more than 10% since hitting a five-month high of $33.28/tonne at the start of June, in line with a more than 8% drop in equities over the same period.

The state Air Resources Board hosted a Punic hearing last week to discuss the five-yearly Scoping Plan for climate action through to 2030, which included analysis and projections for the market. The meeting featured contributions from business owners unhappy at the cost of the plan, as well as environmental justice (EJ) activists concerned that the Scoping Plan did not go far enough to address climate change.

Many critics felt that the Plan relied too heavily on the cap-and-trade market and on carbon capture technologies that are yet to expand to a commercial scale.

RGGI

The Northeastern regional market was steady over the past week, with prices sitting close to $14/short ton as traders continued to await news from Pennsylvania and Virginia over whether those states would continue to participate in the market.

Pennsylvania's power sector cap-and-trade took effect on July 1st, which now makes the state eligible to become the 12th member of RGGI. However, a court decision regarding the state's participation still awaits. Meanwhile, Virginia’s governor is expected to introduce legislation to withdraw the state from the market in the third quarter.