RGGI YTD Update

4 Min. Read Time

Highlights

- Pennsylvania is expected to join RGGI by the Q3 2022 auction.

- Virginia Gov. Glenn Youngkin continues to try to withdraw Virginia from RGGI, but so far has been unable to overcome opposition from Senate Democrats.

- RGGI’s third program review is currently underway, with more ambitious commitments.

Price and Allowance Update:

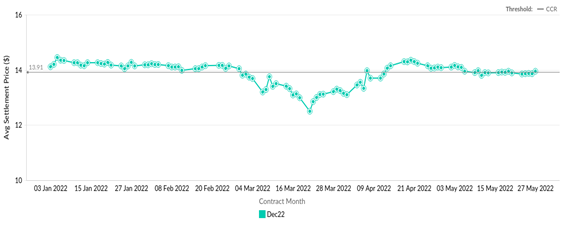

RGGI futures prices dropped 12% in March, driven by investors' concerns about the Russia-Ukraine war. Prices have rebounded since and are now trading close to the Cost-Containment Reserve trigger price (CCR). The CCR1 for 2022 has an 11.5 million allowance reserve that enters the market when the normal settlement price would have been greater than the CCR trigger price. The CCR price is set at $13.91 for 2022, which increases 7% annually.

RGGI announced its Third Adjustment for Banked Allowances (TABA)2 in 2021, which will apply over a five-year period (2021-2025) and result in an annual cap reduction of 16-18%. The downward adjustment of the RGGI cap3 accounts for the surplus of banked allowances accumulated by covered entities in the fourth control period (2018-2020) and is designed to reduce the number of allowances available for auctions in future years by the number of allowances not used for compliance in previous years. The steady decline in the number of banked allowances indicates that there is a high probability that the CCR breaches in 2022, although it is unlikely to impact the pricing of allowances due to the significant stock of allowances available at the CCR trigger price.

Future Program Changes:

RGGI states have continued to update and improve their programs by conducting a regular review process that includes a technical, economic, policy, and stakeholder analysis. Previous program reviews have resulted in more ambitious state commitments to cut carbon pollution and other major improvements. The third program review is currently underway, with the draft model rules to be released in the fall of this year. The expected program changes are as follows:

- RGGI states are seeking to comment on how the Cost Containment Reserve (CCR) and the Emissions Containment Reserve (ECR)4 have worked to date, including considering changes to the quantity of CCR and ECR allowances as well as the established trigger prices.

- The market may support more offset types and standardized protocols. Currently, five project categories are eligible for CO2 offset credit issuance. To track these projects, an offsets module was developed in the RGGI CO2 Allowance Tracking System (RGGI COATS)5.

Pennsylvania is expected to join in the Q3 2022 auction. The state will be the first coal-generating member of RGGI, bringing the country’s largest electricity exporter under an active carbon market. Pennsylvania will produce 74% of coal electricity in the RGGI market. The addition of PA will increase RGGI’s annual auction program revenue from $1.2B to around $2B.

Virginia:

Virginia Gov. Glenn Youngkin (R) continues to try to withdraw Virginia from RGGI but has been unable to overcome opposition from Senate Democrats. The Democrats currently hold a slim majority (21/40) in the Senate and a minority in the House of delegates (48/100). Passing any bill to remove the state from RGGI would require a majority in the House and Senate.

Gov. Youngkin hopes to pass an emergency regulation to pull Virginia out of RGGI, which is expected to come before the board this summer (as soon as July 1st). However, analysts don’t see it getting approved, with the NRDC noting that “judges do not look favorably upon unconstitutionally taking an ax to statute", especially under an 'emergency' order.

Moreover, an official advisory opinion from the outgoing Democratic Virginia Attorney General, Mark Herring, says Gov. Youngkin cannot withdraw the state from a regional carbon market solely through executive action.

Pennsylvania:

Pennsylvania Governor Tom Wolf (D) issued an executive order in 2019 to have the Department of Environment Protection (DEP) develop regulations to join RGGI. However, Wolf has been met with strong opposition from Republican state lawmakers who have tried to through various measures to prevent PA from entering the market. They claim that the governor's order is unconstitutional on the basis that the money raised by the program amounts to a tax, which only the legislature may enact. Despite their attempts at halting PA from entering RGGI, i.e. passing the Senate Concurrent Resolution 1 (SCR1), Gov Wolf vetoed their resolution and the DEP won the case.

According to the regulations of the DEP, power plants must start accounting for their CO2 emissions starting on July 1, 2022. Power plants will be required to have 50 percent of their 2022 required allowances by March 1, 2023, and 100 percent of required allowances by March 1, 2024.

Notes

- CCR is an additional supply of CO2 allowances that are made available for sale if CO2 allowance prices exceed certain price levels (the “CCR trigger price”).

- TABA is a reduction in the states' CO2 allowance base cap equivalent to the private bank of CO2 allowances (allocation years 2009-2020). For 2022, the RGGI cap is 116,112,784 CO2 allowances and the adjusted cap is 97,022,454 CO2 allowances

- The RGGI cap represents a regional budget implemented by the RGGI participating states for CO2 emissions from the power sector.

- The Emissions Containment Reserve (ECR) is an amount of CO2 allowances that are withheld from sale if CO2 allowance prices fall below certain price levels (the “ECR trigger price”). The ECR trigger price is $6.42 in 2022 and will increase by 7% per year thereafter. The ECR is currently 10 percent of the annual base CO2 allowance budget of each state implementing the ECR.

- The RGGI COATS offsets module is used to register offsets projects, track offset project Consistency Application and Monitoring and Verification Report submittals to RGGI states, track project regulatory status and the award of CO2 offset allowances, and provide public access to offset project documentation.