Carbon Making New Levels: EU and California

By Luke Oliver

2 Min. Read Time

Both of the major global carbon markets, EU and California, have had strong trading and telling activity this week following lower fund flows in the past two weeks. We are eyeing this activity with a view to markets potentially moving higher as investors regain confidence and positive policy drivers are recognized.

Californian markets have had 5 straight up days, totaling around +13%, and breaking the downtrend we’ve observed since mid-November. Europe also tentatively broke above a key level. Both of these moves have caught investors and traders attention.

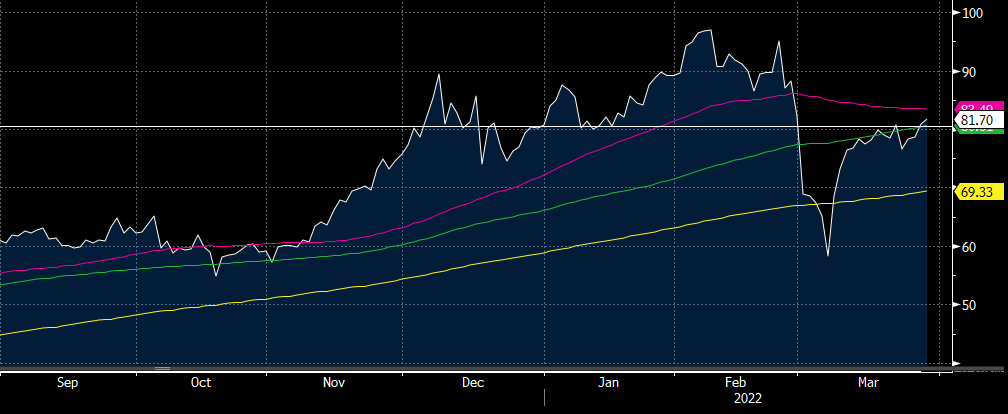

European carbon broke out above the 80 euro price we have observed as acting as a technical, or rather psychological, level. 80 euros has alternatively offered resistance or support in past months with the exception of two sharp sell-offs. The level was first tested on December 2nd and we have tested it twice since the Russian invasion of Ukraine. On March 28th we crossed through intraday, as high at 81.99, before coming down to close just above the line. We watched eagerly to see if the move higher on the 29th would break higher or return below the level. The December 2022 futures on the European Union Allowances closed at 81.70, which could suggest a compelling entry point.

What's driving this? Let’s remember that the sharp sell off was purely technical driven by option unwinds and momentum traders as uncertainty spiked in the early days of the invasion. The pundits pointed to various theories for why fundamentals could explain the drop, chief among them that sky high energy prices could lead to easing of climate policy. Since then, the Market Stability Reserve, which tightens supply by absorbing 24% of EU auctions, has been reaffirmed. The Fit-for-55 program that strengthens the EU ETS in many ways, including doubling the linear reduction of allowances to 4.2% per year has been reaffirmed. And the European Securities and Market Authority (ESMA) published its Final Report – Emission Allowances and Associated Derivatives which, though may recommend some changes to reporting and position management, found “no major deficiency” in the EU ETS. These constructive clarifications have removed much of the concerns the market voiced at the height of the sell off.

Today, the main concern that remains is the risk of recession that could reduce emissions. However, this could be offset by increased emissions from Europe using more coal in the face of reduce supply and higher priced “greener” natural gas. The tightening of EUA supply should also go a long way to detaching EUAs from economic cycle.

With these potential risk factors addressed and the 50 day moving average just 2% away at 83.49 Eur, the next few weeks could be interesting.

EUA Dec '22 Futures

California’s strong few days also made technical news, clearly breaking the down trend since peak mid-November. Note that not even I (nor Bloomberg) have live CCA pricing so I had to tap my trading colleagues and add todays price manually! You may recall that the weak Q4 auction created a strong price correction. However, this was somewhat overblown as we said at the time. It was a record auction price with the greatest compliance entity participation to date… hardly a failure. However, the market cooled especially as focus moved to EU, RGGI and offset markets. One of the key drivers for this change in sentiment is the increasing number of California Air Resource Board members calling for tightening of the program, à la Europe’s “Fit-for-55”, that could result in upward price pressure.

However, perhaps the biggest driver, no pun intended, is Governor Gavin Newsom’s proposed $9bn tax relief for rising gas prices, announced last week. This is NOT good for the environment, as it will encourage continued gasoline emissions. However, it could support higher carbon prices which should create long term lower emissions.

Stay tuned.

CCA Dec '22 Futures