EU Emission Trading System (EU ETS)

<1 Min. Read Time

Description:

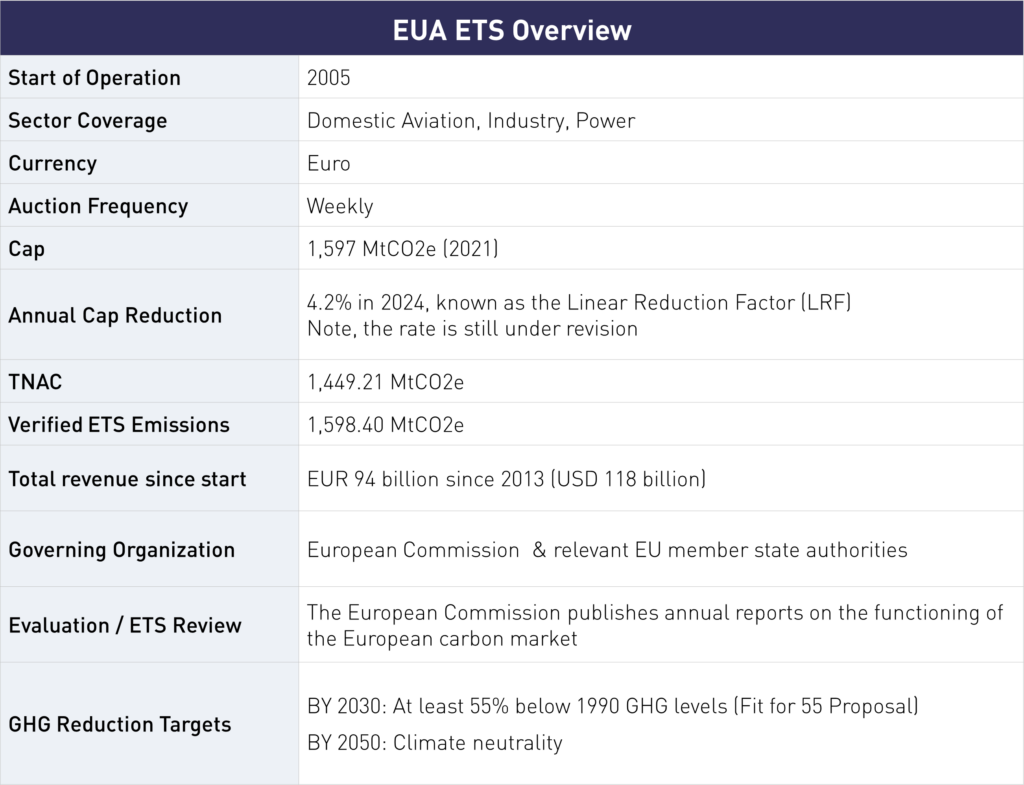

The EU ETS is the oldest emissions cap-and-trade program, first launched in 2005. It covers ~40% of the total EU emissions, including activities from the power sector, manufacturing industry, and aviation (including flights from the EU to the United Kingdom). In 2020, Switzerland linked with the EU ETS. Since inception, stationary installations have seen an emission reduction of around 43%.

Year in Review:

In 2021, the EU ETS entered its fourth trading phase. New policy reforms were introduced under the “European Climate Law,” which set new regional climate targets including a 55% cut in GHG emissions compared to 1990 levels by 2030 and climate neutrality by 2050. The European Commission’s proposed reform package, known as Fit for 55, that calls for several revisions to the EU ETS. The package is not yet finalized as it is currently under review by the EU legislature.

Key changes included in the package are: an increased linear reduction factor from 2.2% to 4.2%, and a one-off reduction to the cap; a phasing-out of free allocation to the aviation sector; introduction of a carbon border adjustment mechanism (CBAM); updated MSR parameters such a lower price spike trigger mechanism and an extension of the current intake rate of 24% beyond 2023; inclusion of the maritime sector and a separate fuel-based ETS for buildings and road transport; and, greater regulation on revenue investments.

Source: International Carbon Action Partnership, “EU Emissions Trading System (EU ETS) Factsheet,” retrieved 12/31/2022