EUAs Bounce Back As Trump Tariff Threat Recedes, Market Continues To Digest ISOR

3 Min. Read Time

It was a rollercoaster last week for European carbon. Both EUAs and UKAs initially dropped sharply in response to President Trump’s tariff threats on EU and UK imports over Greenland, before recovering in the second half of the week as those threats were withdrawn.

Crucially, the fundamentals in both markets remain unchanged, and the positioning shakeout triggered by the threat of tariffs, in our view, is healthy. For CCAs, following the excitement of the previous week when the California Air Resources Board (CARB) finally released its cap-and-invest reform proposals, i.e., the Initial Statement of Reasons (ISOR) package, it was a quiet, slightly softer week as the market continued to digest the long-term implications of the ISOR.

EUAs and UKAs recover after Trump tariff threat, fundamentals still very supportive

Prices for EUAs and UKAs ended last week at €88.4/t and £68.3/t, down 4% and 4.3%, respectively, on the week. However, these levels represented a recovery from the lows of January 20th, when the selling pressure associated with President Trump’s threats to impose fresh tariffs on selected EU countries and the UK over Greenland was at its greatest. EUAs touched an intraday low of €83.5/t on January 20th, while UKAs reached a low of £64/t. Although they both ended down by Friday’s close, they were up 6% and 7% respectively from the week’s lows, which are also the year-to-date (YTD) lows so far.

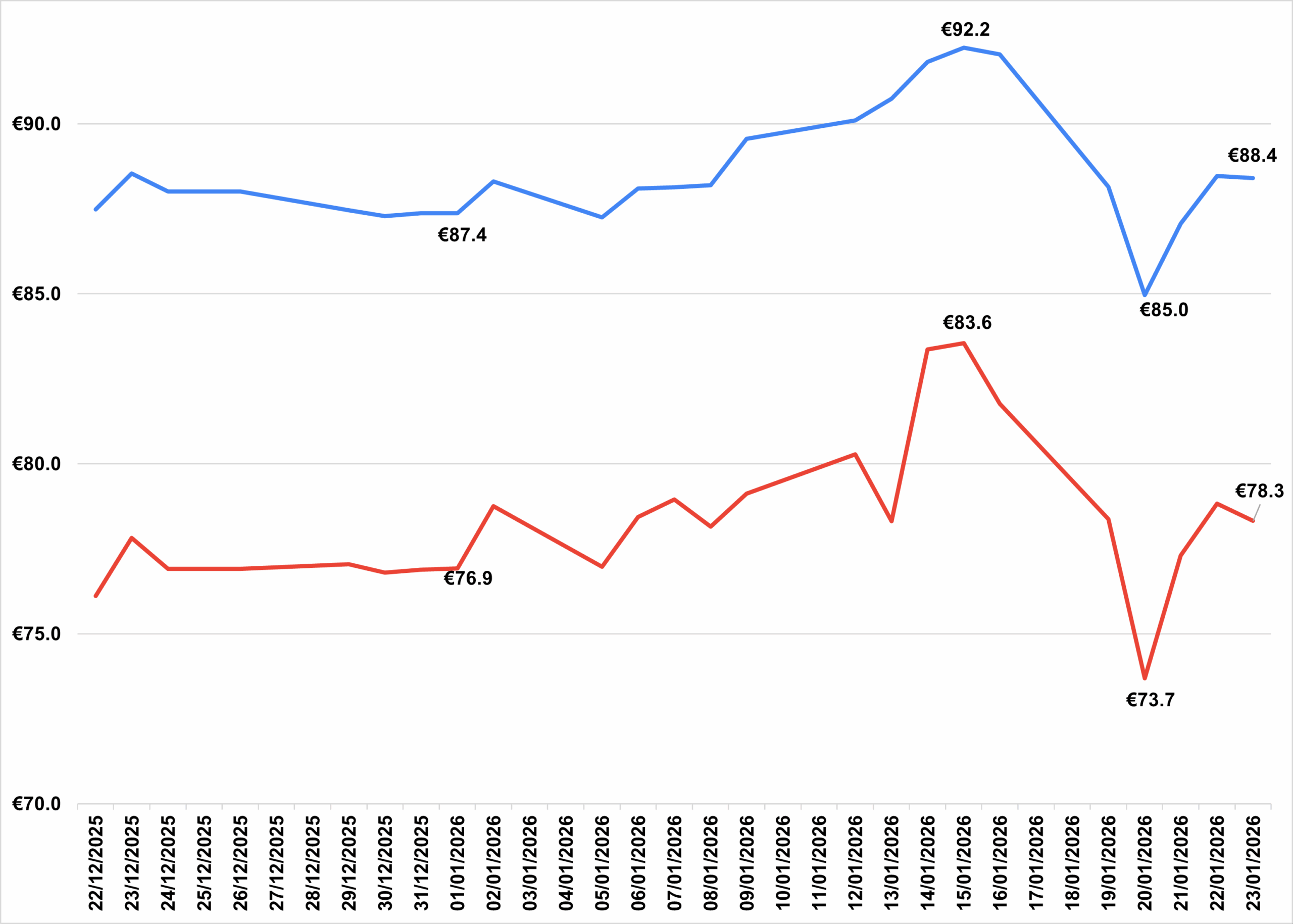

Figure 1 shows the performance of the benchmark EUA and UKA contracts since December 22nd, with UKAs converted from GBP into EUR. As can be seen, the price action over this period has been essentially identical, reflecting both the extent to which the EU and the UK were faced with President Trump’s tariff threats over the last week and the political momentum behind linking the UK-ETS with the EU-ETS. EUAs and UKAs closed last week up 1% and 2%, respectively, against December 31st prices.

Figure 1: EUA/UKA* Closing Prices From December 22nd, 2025 Through January 23rd, 2026 (€/tonne)

Source: Bloomberg; *Note that UKA prices are here shown in €/tonne to show the discount at which they still trade to EUAs.

The volumes traded last week were well above average, with 300Mt of turnover, the second-highest weekly volume on record, including an all-time high (ATM) daily volume trade of 95Mt on January 21st. In the prior week, the latest Commitment of Traders (CoT) data released by the ICE exchange showed a slight increase in speculative net length of 300Kt to a new ATH of 126Mt.

After last week’s huge volumes, we expect the latest CoT data, released this week on January 28th, for positioning as of the close of business (COB) on Friday, January 23rd, to show a material reduction in net speculative length.

Overall, however, we think last week’s correction in both EUAs and UKAs, and the subsequent rebound back to year-end price levels, is healthy in the context of such a massive recent accumulation of speculative length, and we continue to view the supply/demand fundamentals in the EU-ETS as constructive on a medium to long-term basis.

CCAs were quiet last week as the market continues to digest the ISOR

The Dec-26 CCA contract closed last week at $31.16/t, down 2% on the previous week’s close of $31.78/t, and down 5.3% YTD. We think the softer market tone following CARB’s publication of the Initial Statement of Reasons (ISOR) mainly reflects lingering concerns about the possibility of federal action against US state carbon markets and the ISOR's backloading of the cap reduction to 2028-30, leaving 2027 still well supplied.

As we said in last week’s blog, however, we think the ISOR is positive on fundamentals. In our reading, the ISOR implies a reduction in the cap over 2027-30, very close to our own base-case modelling of 155Mt. After factoring in our demand forecasts, we project a total drawdown in the number of banked allowances over 2026-30 of 197Mt. On our numbers, this leaves the remaining bank at 169Mt at the end of 2030, versus 366Mt at the end of 2025.

As a result, we would expect both compliance entities and investors to become more constructive on the outlook for prices in the coming weeks and months.

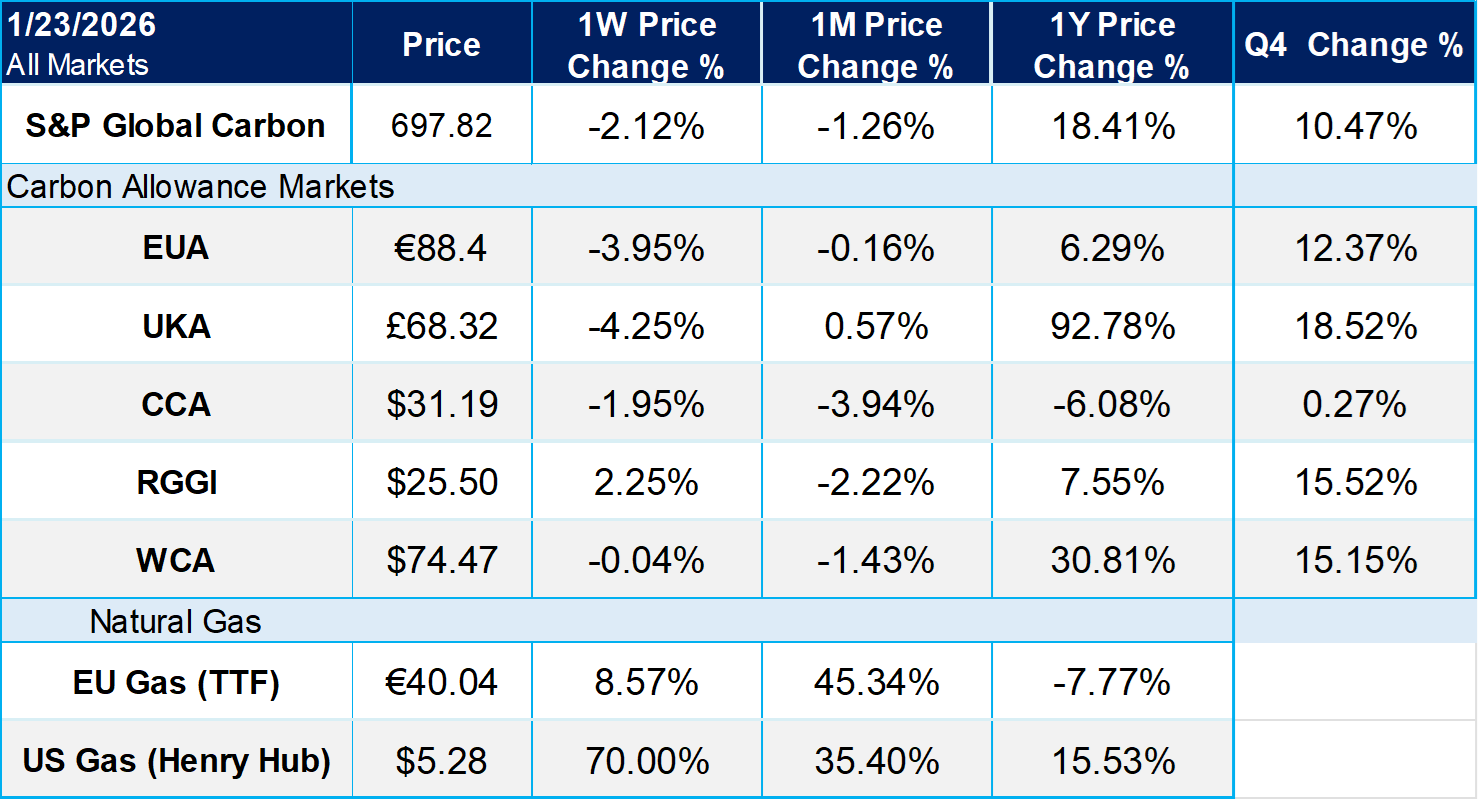

Carbon Market Roundup

The weighted global price of carbon was $60.33, down 2.12% week over week. EUAs fell 3.95%, closing at €88.40. UKAs fell 4.25%, finishing at £68.32. CCAs slipped 1.95% to close at $31.19. RGGI allowances were up 2.25%, at $25.50. Washington was flat, at $74.47.