CCA Auction Clears at the Floor, Creating Compelling Upside Potential

<1 Min. Read Time

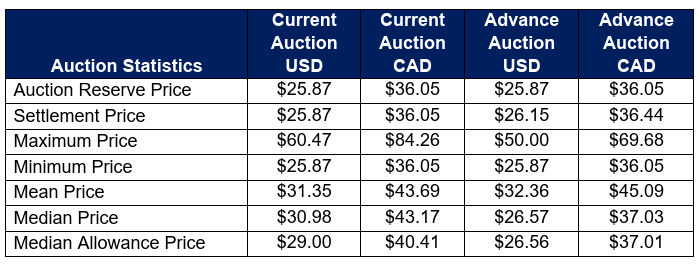

That's it folks, CCAs are at the floor, creating compelling upside potential. The second auction of the year, held on May 21, cleared at the auction reserve floor of $25.87 on lighter participation. The clearing price was $3.40 below the last auction held in February. Compliance entities contributed to 81% of allowance buying, which is slightly less than last quarter's 83%.

For further context, the floor price sets a minimum price level for CCAs at auctions, meaning allowances can't clear below the floor. This floor price increases annually by 5% plus CPI to help maintain upward price pressure in the market. CCAs can trade under this level in the secondary market, however, prices generally don't stay below the floor for prolonged periods.

For the first time since August 2020, the auction was undersubscribed with 86% (43.8 million allowances of the 51 million available) of allowances sold. However, the advanced auction was fully subscribed, with all 6.8 million allowances sold at the clearing price of $26.15, which is 6.5% less than the Feb price. This underscores general sentiment around the near term policy uncertainty but long term conviction for CCAs. Collectively, the 57.9 million current and advanced allowances sold generated $1.3 billion in revenue, down 23% from last quarter.

The auction results were largely in line with expectations as the market awaits the next steps for the ongoing reform package and updates on the Executive Order from last month. This waiting period for further clarity has weighed on prices this year driving CCAs near the floor, with the Dec25 futures down 26% year-to-date.

Key to note, markets barely moved as futures were trading in line. Dec25 futures hit a low of the day of $26.26 but reversed back to close at $26.96. Front month futures closed just above the auction settlement price, at $26.06.

At these current levels, CCAs present a strategic play with the market's downside floor, inflation adjustment plus an additional 5% annual step up, and potential for material upside. For more details around the policy and regulatory environment, see our latest article California Carbon Alert: Strategic Opportunity at the Floor.

The full auction results can be found here.

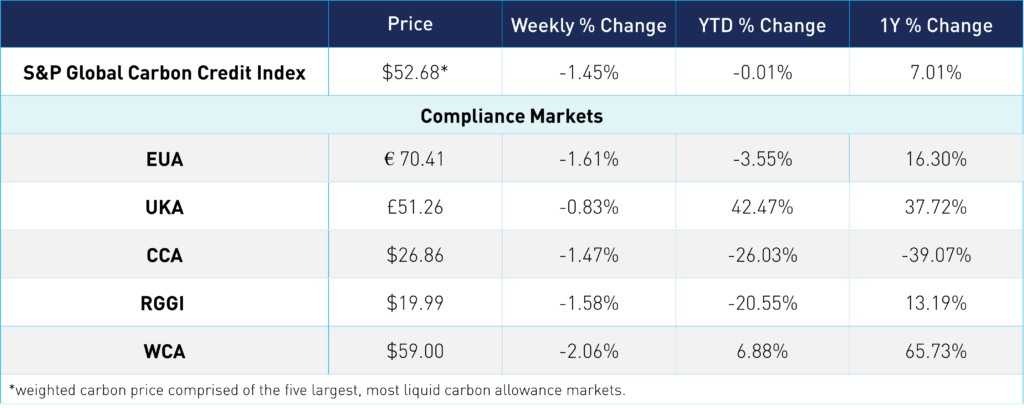

Carbon Market Roundup

The weighted global price of carbon is $52.68, down 1.5% week over week. EUAs were down 1.6% at €70.41. UKAs were down 0.8% to close at £51.26. CCAs were down 1.5% at $26.86. RGGI closed down 1.6% at $19.99. WCAs were down 2.1% at $59.00.