EUA Revised Price Outlook, CARB Announces Next October Workshop

3 Min. Read Time

At last week’s Carbon Forward conference in London, European carbon market analysts shared constructive views for the EU ETS in the coming months, pointing to the sharp downward adjustment in allowance supply and highlighting large speculative positions already built up ahead of a widely anticipated price rally.

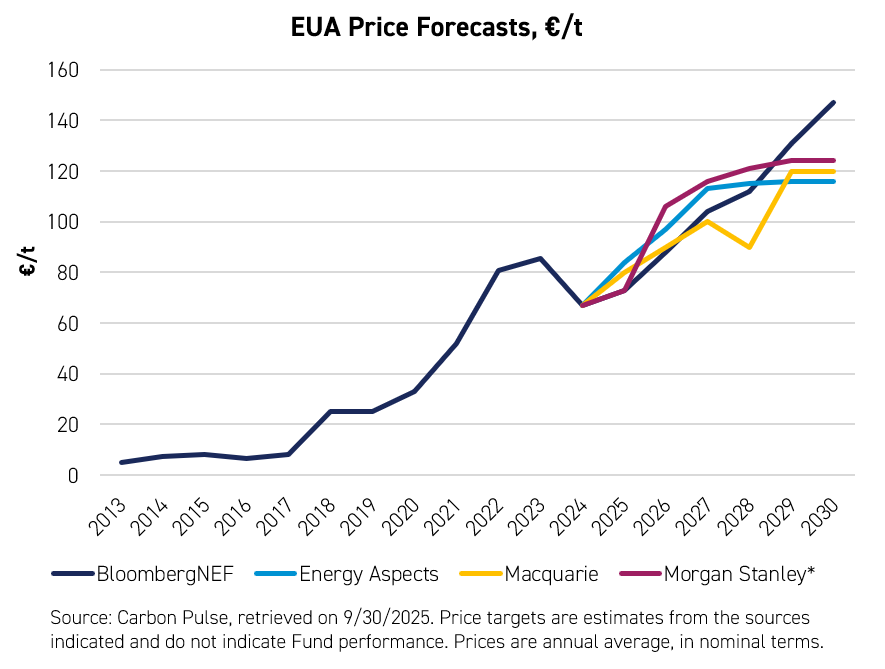

In a debate format, analysts Louis Unstead of ICIS and Trevor Sikorski of Energy Aspects offered respectively bullish and bearish takes on the EUA outlook for the next few years. (Outside the debate, both analysts have predicted carbon should exceed €100/tonne by the end of 2026.)

Louis Unstead of ICIS predicted EUA prices could reach €85 by the end of 2025 and surpass €100 by 2027, driven by these supply shortages. ICIS forecasts an annual supply shortfall of around 158 million EUAs in 2026 and 166 million in 2027, as the REPowerEU fundraising sales come to an end, the allocation benchmarks are tightened, and the overall cap undergoes its second adjustment.

Unstead emphasized that the demand side is becoming more price-inelastic as well: “we don't see much responsiveness in demand to changes in EUA prices,” he said. “Fuel-switching potential in the power sector is quite quickly exhausted.”

“And we’ve got industrials that still receive a lot of free allocation, even next year, so they're not truly feeling the CO2 price yet,” he added. “So the critical question for next year is who's going to be willing to sell and at what price?”

Making the bear case, Trevor Sikorski of Energy Aspects pointed out that the demand side is much less bullish. “Industry is struggling to get back into growth,” he said. We’ve seen lots of permanent demand destruction in a number of energy intensive industries: refining chemicals. That is demand which is never going to come back.”

Sikorski pointed out that while the allowance supply picture is largely known, apart from an auction adjustment for the maritime sector, the overall macroeconomic environment and the European Union’s response to the current downturn is less well-known.

He outlined some potential measures, such as renewed “front-loading” of allowance supply to help fund a new European Industrial Decarbonisation Bank, that could impact EUA supply as soon as 2027. “If you put [additional supply] into 2027 then all of a sudden, in 2026 everyone's going to say, ‘actually, this is a market which is nowhere near as short as we thought it was going to be.’”

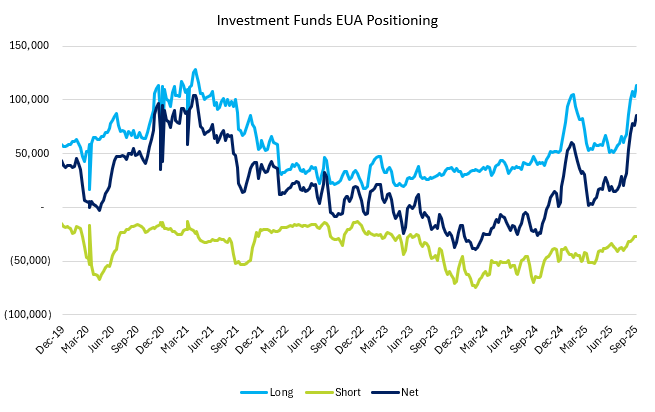

Sikorski conceded that speculative traders are positioned heavily long, as last week’s Commitment of Traders report confirmed. But he wondered how much more capital can be moved into carbon. “This is a market which is super long. How much more capital can we throw at this market?” he asked. “We’ve run out of bullets and we haven't even got to €80.”

Alongside Sikorski and Unstead, Huan Chang of BNEF saw EUA prices edging just above €100 by 2027, while Marcus Ferdinand of Veyt predicted the price would top €150 by the same time.

Longer-term, three of the analysts saw a steady rise in carbon prices out to 2035, though Energy Aspects saw potential for EUAs to flatten at €100-€150/ton between 2027-2033.

While the conference was taking place, EUA futures were testing a major price level at €80 last week. A brief surge to €80.11 on Monday was very quickly sold back to around €78.00, but as the week nears the end, bulls are again in the driving seat and the market looks set to explore the €80.00 level.

California Carbon Market Workshops Are Back

California's market regulator, CARB, also announced its next workshop: Wednesday, October 29 at 12pm ET. The market is closely watching for clarity on how CARB will explicitly align with the recently passed AB 1207 and SB 840 legislation, specifically on key items including:

- Offset eligibility and allowance budget reductions tied to offset use

- Updates to free allocations and carbon leakage rules

- Revenue spending plans and addressing affordability concerns

- Potential amendments on the Cost Containment Reserves

Click here for more details and registration.

Carbon Market Roundup

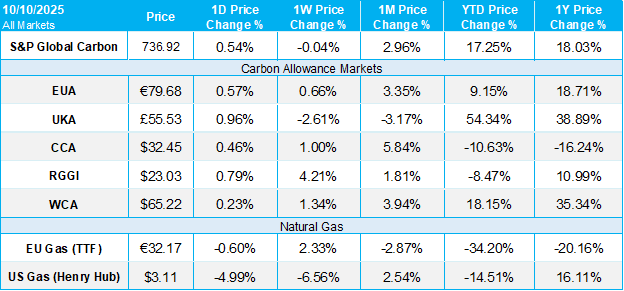

The weighted global price of carbon was $55.90, flat week over week. EUAs were up 0.7% for the week, closing at €79.68. UKAs trended down 2.6% to end at £55.53. CCAs saw a 1.0% gain over the week, settling at $32.45. RGGI was up 4.2% at $23.03 and WCAs were up 1.3% at $65.22.