What to Make of the Remaining REPowerEU 2026 Volumes

2 Min. Read Time

| Global Carbon Summer Report |

| Stress-Tested and Steady: Carbon Markets Hold Firm Amid Geopolitical Shocks and Domestic Policy Tension Q2 recap and outlook across the five primary carbon markets. Read here |

We are coming up to the end of the "REPowerEU" surplus sales, which, once these frontloaded allowances come out, are set to tighten up the market. The remaining volumes for next year have been confirmed, with the European Commission adding a total of 14 million EUAs over the period between January and August, largely in line with expectations.

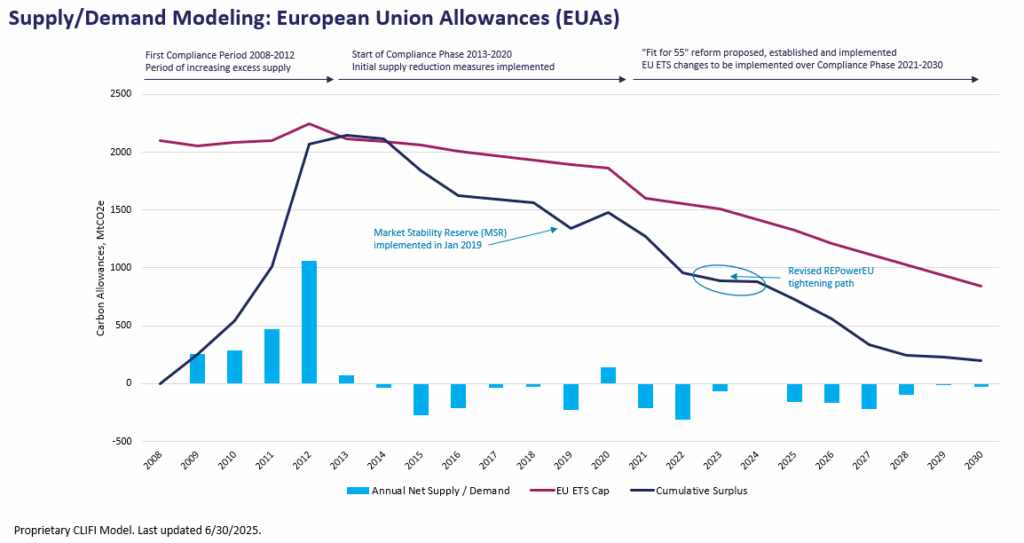

The European Commission introduced REPowerEU to phase out Russian fossil fuel dependency and increase Europe’s renewable capacity following the Ukraine invasion by raising €20 billion partly funded by the EU ETS. A portion of EUAs that were originally set to be auctioned in the later half of the decade were brought forward, effectively frontloading EUAs to be sold earlier during the 2023-26 period. This frontloading created added supply in the short term which will now start to get offset in 2026 when the frontloading ends as there will be that same portion of allowances taken out of the supply from then on.

Let's take a step back. What was the market doing before REPowerEU... what did it do during... what do we think will happen after?

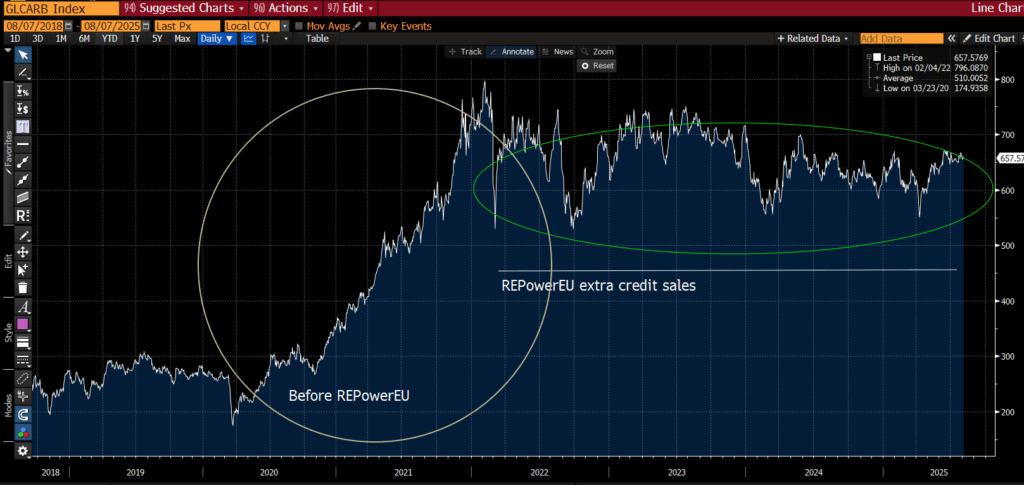

Check out the chart below, which shows how the S&P Global Carbon Credit Index saw a strong linear move higher in the two years prior to the Russian invasion of Ukraine and the introduction of the REPowerEU initiative.

The market was then held in a tighter range as it asborbed the added supply which partly resulted in supressed prices. We see the market breaking out from this range ahead of REPoweEU sales ending. We've detailed our expectations in our supply/demand model for the EU ETS below, where the cumulative surplus continues to drop sharply as the REPowerEU sales recede.

REPowerEU 2026 Schedule:

The REPowerEU program is scheduled to end in August with a total of €20 billion raised for the Resilience and Recovery Fund (RFF). This translates into a total of 93.3 million EUAs to be sold for REPowerEU next year – compared to this year’s January-August total of 58.6 million.

Despite this 60% year-on-year hike in REPowerEU volumes, analysts remained steadfast in their predictions that EUA prices are set to rally in 2026, since the REPowerEU program will come to an end, and member state auction supply will drop sharply as a result. Vertis notably raised their 2025 EUA price forecast by 10% to nearly €78, and increased their 2026 projections to €110, up from €93 previously, citing a boost from REPowerEU receding and free allocation phase out alongside an increase in shipping and aviation emissions.

Trade Deal Implications Continued

Meanwhile, the deadline for the EU and US to reach a trade deal passed at the end of August, with the agreement of a 15% tariff for European imports into the United States.

The increased levy is likely to impact European industrial output by limiting the volume and value of sales to the United States, and analysts at Macquarie bank estimated the deal could lead to a drop of as much as 41 million tonnes of CO2 emissions.

However, this worst-case scenario assumes no exports at all to the US, and a more realistic scenario estimated a cut of around 20 million tonnes in EU-wide emissions, the bank said, or around 1.5% of the total forecast emissions under the EU ETS in 2025. The analysts reiterated their forecast that the annual supply-demand balance in 2026 would return a deficit of 180 million EUAs, which would have to be met out of existing supply, likely at higher prices.

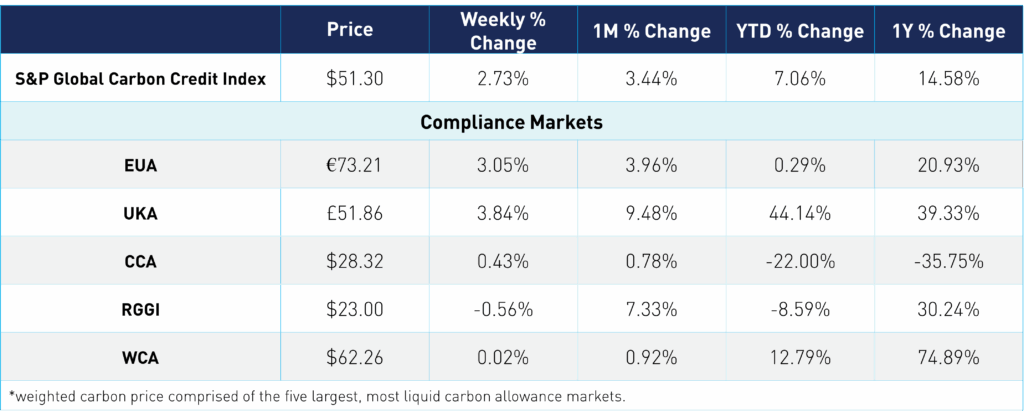

Carbon Market Roundup

The weighted global price of carbon is $51.30, up 2.7% week over week. EUAs were up 3.1% over the week and closed at €73.21. UKAs trended 3.8% higher to end at £51.86. CCAs were up 0.4% at $28.32. RGGI was down 0.6% at $23.00 and WCAs were flat at $62.26.