EU Carbon Hits Six Week High, UKAs Rally Ahead of Brexit Reset Meeting

2 Min. Read Time

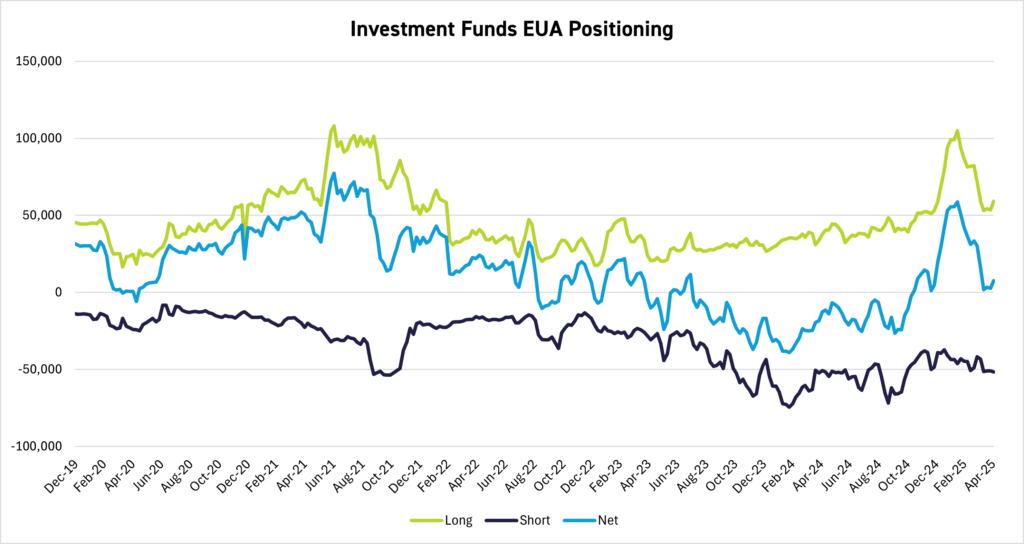

EU carbon allowance prices have hit six-week highs amid a technically driven rally that has seen speculative long positions increase to the highest level in more than a month.

December 2025 EUA futures reached €71.76 on Wednesday last week, the highest price since March 26, after the weekly Commitment of Traders report showed investment funds had increased their net long positioning to 7.5 million EUAs as of May 2 from 2.7 million the week before.

The rally dates back to April 9, when EUAs fell to a six-month low of €60.07 in the wake of the announcement of wide-ranging US import tariffs, which had triggered sell-offs across many commodity and financial markets. Front-month TTF natural gas futures had tumbled 25%, Brent crude fell 15%, and even Rotterdam coal slid 6% as a wave of “risk-off” sentiment roiled markets. However, as some of President Trump’s tariffs were walked back, reduced, or postponed, trader sentiment began to recover, setting the scene for a rally that has seen many markets stage rallies.

TTF gas has been notably absent from this list as the European market buckles under the sheer weight of supply, and this may have tempered some of carbon’s recovery. With Asian demand for seaborne gas cargoes falling away amid depressed demand, front-month TTF gas kept weakening, dropping to as much as 22% down for the year to date.

However, EUAs found healthy compliance demand at prices close to €60, and this support gave the market some confidence in analyst outlooks for higher prices in the second half of the year. Since bottoming at €60.07, the EUA market has recovered by as much as 18%, breaching a key technical resistance at the 200-day moving average of €70.68, and traders are now eyeing the 100-day average at €72.10.

Across the Channel, the UK ETS has seen futures prices jump to their highest in six months as speculation and anticipation mount that UK and EU leaders may agree to link their respective carbon markets. UK prime minister Sir Keir Starmer and EU Commission President Ursula von der Leyen will meet on May 19 to discuss “resetting” the relationship between Westminster and Brussels after years of tension in the wake of the UK’s departure from the EU.

Numerous media reports have asserted that the agenda includes discussion around linking the UK and EU ETS, which would align the British market with the parameters of the European system. This would likely fast-track ambitious changes to the UK ETS, such as introducing a supply adjustment mechanism to absorb market surplus and price-control systems to match the EU’s.

While there have been no official statements confirming that the May 19 talks will include carbon markets, investment funds have been busily accumulating their largest-ever net long position in UKAs. As of May 2 they held a total of 18.3 million UKAs in net length. This steady growth in bullish positions has driven December 2025 UKA futures prices to a high of £51.61, the most since October 16 last year. At the same time, the UKA-EUA spread has shrunk to just -€9.50, near its lowest in two years.

The spread between the two contracts had widened to -€42.00 as recently as January, when traders’ pessimism over the prospects for reform was at its peak. The spread had narrowed to -€9.50 in June last year when the current government was elected, as traders expressed optimism that market reforms would be high on the agenda, but the lack of any news or proposals in the first six months had slowly dampened the bullish sentiment. That’s all changed again, and traders are likely to continue accumulating length in the run-up to the meeting, but numerous stakeholders have warned that if the outcome is less than a clear statement that the two markets are to be linked, then the market is likely to see a steep sell-off.

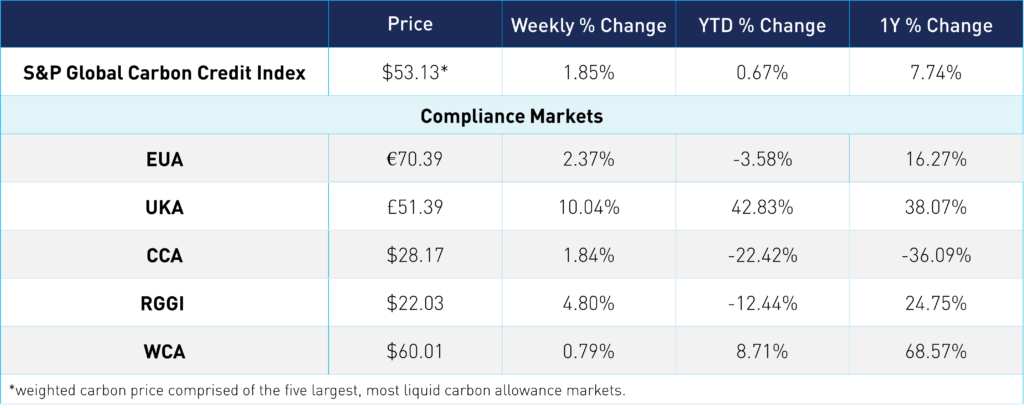

Carbon Market Roundup

The weighted global price of carbon was $53.13, up 1.9% week over week. EUAs moved 2.4% higher over the week to close at €70.39. UKAs rallied 10.0%, ending at £51.39. CCAs were up 1.8% to close the week at $28.17. RGGI was up 4.8% at $22.03. WCAs were relatively flat for the week, up 0.8% at $60.01.