Carbon Market Roundup, 2024 Review

3 Min. Read Time

Carbon prices in the four main markets have seen contrasting fortunes in 2024. The RGGI market experienced a substantial price increase this year. In contrast, California, the UK, and the EU markets saw year-on-year declines amid weakening fundamentals and concern at regulatory delays.

In the US, the RGGI and California cap-and-trade systems faced the same regulatory processes designed to update the markets’ caps for the next phase, but the markets reacted in very different ways.

The RGGI market is up by around 43% since the same time in 2023, as traders have speculated that regulators will cut the next phase’s cap by a significant amount to account for a large volume of unused allowances.

December 2024 RGA futures started the year at a record high of $16.80/short ton but climbed steadily as the first auction of the year cleared above the trigger, pried to release the full volume of the Cost Containment Reserve for the year.

This additional supply fed into bullish sentiment over demand, bolstered by strong power generation figures in mid-year as the region experienced high temperatures.

Secondary market prices continued to climb, reaching successive records until the December contract hit $27.89/ton in August.

Prices slowly drifted back down during the remainder of the year as the market lost some confidence in the slow pace of preparation of the updated model rule.

RGA prices have rallied into the end of the year, briefly touching $27/ton again in the wake of the presidential election and on a Virginia court ruling that the state’s exit from RGGI was unlawful.

On December 17, the front-December contract settled at $23.90/ton.

Prices for California Carbon Allowances have fallen by around a quarter since the start of the year, as traders have interpreted a drawn-out reform process to indicate that there may not be support for ambitious changes to the market.

Most recently, the state’s Air Resources Board has indicated that it will not present its proposed changes until 2025, which the market viewed negatively.

December 2024 CCA futures began the year at record highs, with the final December 2023 settlement at $42.33/tonne representing a record high.

CCA prices got a brief boost after the first auction of the year cleared at a record $41.76/tonne: the secondary market price reached a high of $42.55/tonne but was soon on the back foot as workshops hosted by CARB were deemed to be failing to add any clarity to the state’s reform plans.

December 2024 futures slumped to a low of $30.71/tonne, reacting to weak auction results and a continuing lack of news flow from Sacramento.

The lack of clarity meant that compliance buyers stayed away from the last sale of the year, and speculators took the biggest share in the Q4 auction. Prices last stood at $32.93/tonne.

Across the Atlantic, EU carbon prices also faced challenges in 2024, losing as much as 35% of their value at one point as the market struggled with sky-high energy prices. Industrial production continues to weaken; Purchasing Managers’ Index readings have remained steadily below 50%, suggesting production is in decline.

The power sector has also fared poorly, as the immense growth in renewable energy generation has led to double-digit declines in coal and gas output. Hedging demand for EUAs has consequently shrunk, contributing to the fall in prices.

Investors identified the trend early and held overall net short positions in EUA futures until late in the year when they moved to net length in anticipation of a slow rally in EUA prices.

EUAs are ending the year at just under €69.00/tonne, a yearly drop of 15%.

The UK ETS has experienced a similar story to US markets, with delayed, long-anticipated reforms. The market has been particularly awaiting the introduction of a supply adjustment mechanism that would act like the EU ETS’s Market Stability Reserve, removing surplus allowances from the market each year.

Westminster is also expected to propose adjustments to its cap for the 2027-2030 period and is consulting on various technical issues, including those related to the market’s scope. Despite the key consultation on the supply adjustment mechanism and the market cap launching more than a year ago, there is no sign of any response from the regulator, and traders have been voicing disappointment.

However, anticipating an eventual proposal has led investment funds to take their largest-ever long positions in UKAs this year. While prices continue to fluctuate around the £33-£34 level as the end of the year approaches, this speculative length shows little sign of going away.

Although 2024 has been a mixed year for carbon markets, the long-term fundamentals remain strong across all key regions. We can anticipate an uptick in prices in 2025, driven by factors such as the inclusion of the maritime sector in the EU's Emissions Trading System (EU ETS), the gradual phase-out of free allowances in the EU ETS through the Carbon Border Adjustment Mechanism (CBAM), and California reaching agreements on critical proposals.

Carbon Market Roundup

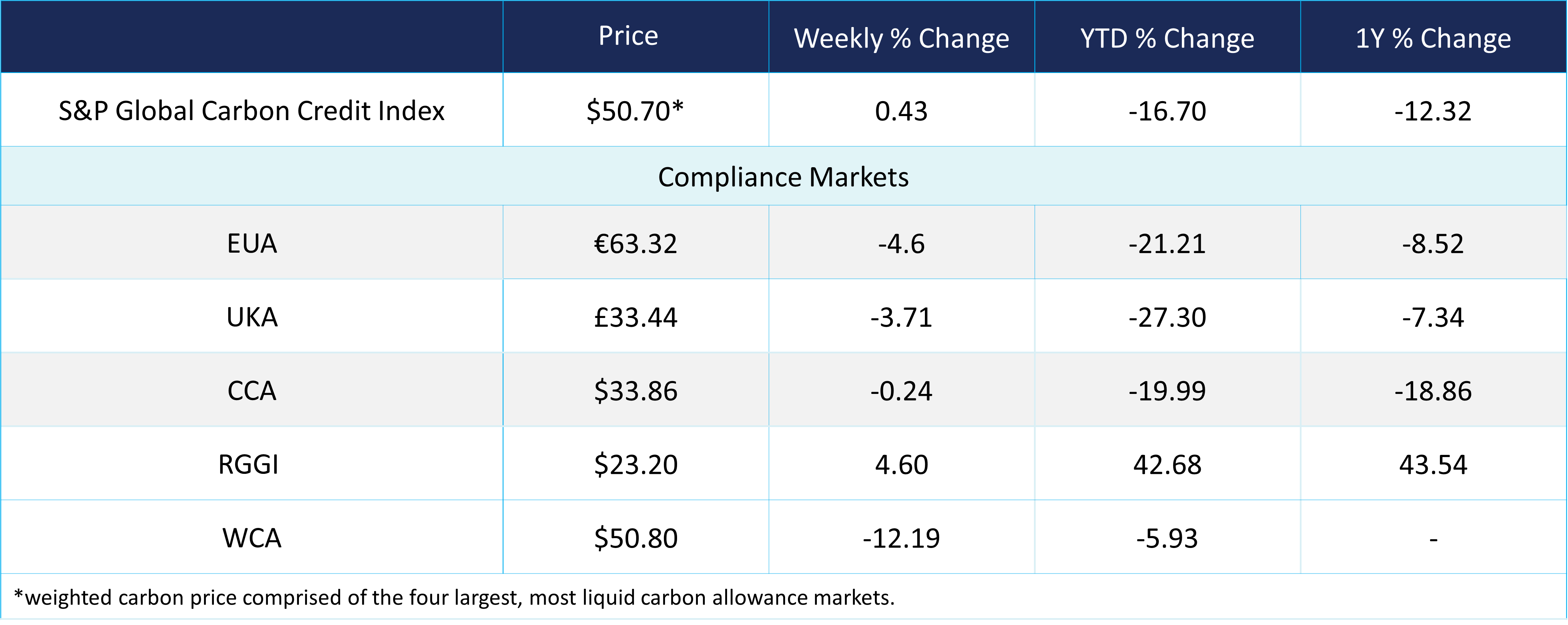

The global weighted price of carbon is 50.7, up 0.43% from the previous week. EUAs are down 4.6% for the week at €63.32, while UKAs are down 3.71% to £33.44. CCAs trended down 0.24% at $33.86. RGGI was up 4.6% at $23.20.