California Carbon Prices Rally Ahead Of August Auction

2 Min. Read Time

California carbon prices have rebounded from recent lows below $32.00/tonne as the third quarterly auction of the year approaches. Traders are awaiting progress on market reforms, which has contributed to this uptick.

After hitting a low of $31.95 in late July, prices have recovered slightly and have been consolidating in the $33.50-$34.50 range over the past week. Traders are positioning themselves ahead of the August 14 auction, where the state will offer 51.2 million current-vintage and 7.2 million forward-vintage permits.

Analysts project a settlement price in the $32.25-$33.25 range for the auction. Many participants anticipate a discount to front-month futures, reflecting a cautious outlook driven by bearish sentiment following ARB’s July 10 workshop (see details below).

The premiums in recent auctions have surged to historic highs. In the last sale of 2023 and the first auction of 2024, premiums reached 73-74%, compared to historical averages of 16.5% and 9.7%, respectively.

The most recent sale in May cleared at a 54% premium over the $24.04 reserve price, signaling a decline in market confidence. This drop coincides with delays in the regulatory process for the 2026-2030 period reform.

Secondary market prices have fallen more than 15% since early Q1, when CCAs traded above $41/tonne. The updated regulations are expected to be approved in time for implementation next year. However, CARB staff indicated during the July 10 stakeholder meeting that a delay is likely to ensure proper approval of the reforms before implementation.

Following the initial price drop after the delay announcement, prices have been recovering as traders position themselves for the auction, with indications of potential upside in the auction outcome.

The latest CFTC position report reveals that compliance entities still have significant buying needs, with their net length in futures and options at its lowest for the year. With the November 1 compliance deadline approaching, this auction may present a valuable entry point for investors. ClearBlue Markets analysts anticipate "opportunistic buying," while others expect long-term bullish trends to drive aggressive bidding and higher prices.

In Europe, the December 2024 EUA futures contract has been on an upward trajectory since reaching a recent low of €64.24 on July 22. This rally has coincided with a period of short-covering by investment funds, reducing their net short position from 25 million tonnes to just under 15 million.

Meanwhile, funds have increased their overall positions in natural gas in response to geopolitical turmoil in the Middle East and Ukraine’s recent offensive into Russian territory. These developments raise concerns about European gas supply for the coming winter. Despite EU gas storages nearing 90% capacity well before the November deadline and declining EU gas consumption, gas prices have risen to year-to-date highs. As a result, EUAs have climbed to just over €74.00—a 15% increase—on August 12 and are currently consolidating around the €72.00 mark.

Carbon Market Roundup

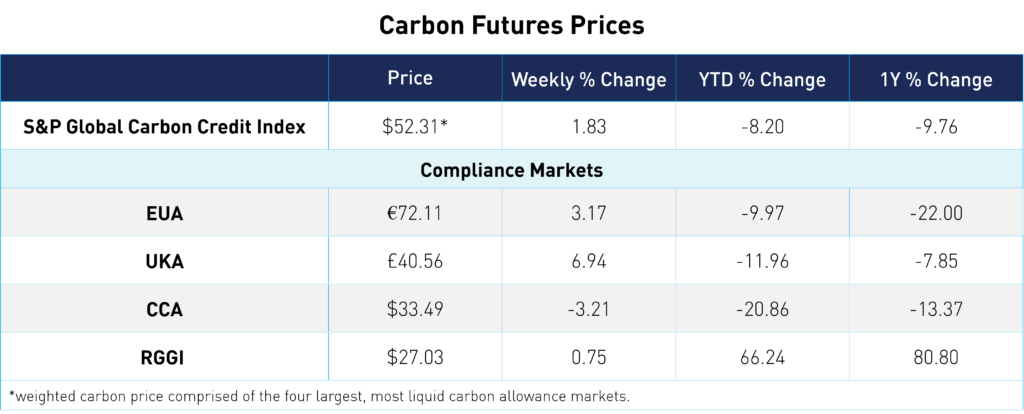

The global weighted price of carbon is $52.31, up 1.8% from the previous week. EUAs are up 3.2% for the week at €72.11, while UKAs are up 7% to £40.56. CCAs trended down by 3.2% at $33.49. RGGI was up 0.8% at $27.03.