ASX Enhances Australia and New Zealand Carbon Markets with New Futures Contracts

2 Min. Read Time

Australia and New Zealand continue to take steps toward decarbonization by promoting more liquid carbon markets through the launch of environmental futures contracts. The Sydney-based Australian Securities Exchange (ASX) listed futures contracts for Australian Carbon Credit Units (ACCUs), New Zealand Units (NZUs), and Large Generation Certificates at the end of last month.

The introduction of ACCU and NZU futures on the ASX is set to transform the current landscape in Australia and New Zealand. No longer restricted to the limitations of the spot market, the ACCU and NZU via futures contracts open up greater access to these markets and provide a better way to price and hedge risk and exposure while supporting broader net-zero goals in Australia and New Zealand.

The new futures contracts are designed to be listed annually, extending to 5 years, with each standardized contract representing 1,000 underlying units, whether ACCUs or NZUs. The ASX has also temporarily waived transaction fees to encourage engagement and entrance from market participants. The listing of futures is expected to attract greater participation from peripheral parties who traditionally wouldn't have accessed these markets while enhancing liquidity and increasing market confidence.

The ASX Head of Commodities, Daniel Sinclair, explained that "as Australia moves from a voluntary to compliance-led carbon market in step with other global jurisdictions, derivatives markets can play an essential role. The transition to clean energy, by definition, is uncertain, and ASX-hosted Environmental Futures will be a key instrument in managing risk and supporting the net zero targets of organizations and policymakers."

The ASX introduction of ACCU and NZU futures will likely enhance both the Australian and New Zealand markets despite their structural differences. Furthermore, Australia's carbon market is projected to grow significantly and may become one of the world's largest producers of carbon credits, with futures contracts likely generating increased trading volumes. We'll be closely watching these contracts, including their potentially adding them to our global carbon fund.

The Integrity Council for the Voluntary Carbon Market (IC-VCM) calls for improved renewable energy methodologies

The IC-VCM Governing Board determined that eight methodologies for designing and implementing renewable energy projects do not satisfy the additionality criteria of the CCP Assessment Framework. The Board questioned whether these projects would have proceeded without the financial incentive provided by carbon credit revenues. Collectively, these methodologies account for approximately 236 million unretired credits, representing about 32% of the carbon offset market. As the carbon offset market often viewed through a more critical lens in the media, the IC-VCM's recent announcement is a positive step forward for increasing the effectiveness and regulatory oversight of the space. At the same time, the IC-VCM also approved methane-related methodologies, including for projects that detect and repair methane leaks and that capture methane from landfills.

While the offsets credit market is generally not yet at the same level of standardization and quality as the compliance carbon cap and trade markets, they still offer a valuable way to decarbonize industry. In the announcement note, Annette Nazareth, Integrity Council Chair, explained that the "Renewable energy projects financed by carbon credits still have a role to play in the decarbonization of energy grids because it remains challenging for many least developed countries to secure the investment they need to transition away from fossil fuels...More robust methodologies would unlock finance for a new wave of renewable energy projects in places where they are most needed.”

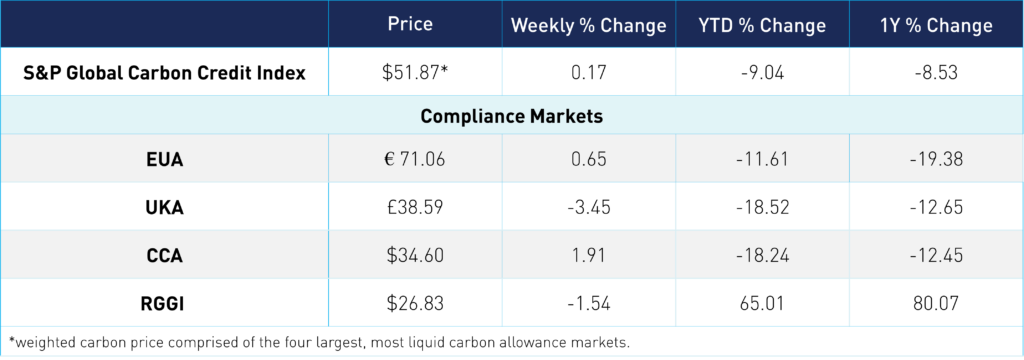

Carbon Market Roundup

The global weighted price of carbon is $51.87, up 0.2% from the previous week. EUAs are up 0.7% for the week at €71.06, while UKAs trended down 3.5% to £38.59. CCAs are up 1.9% at $34.60. RGGI fell 1.5% at $26.83.