Will The EU’s Ban On LNG Transshipments Have Any Impact On EUAs?

2 Min. Read Time

The European Union last week adopted a fourteenth set of sanctions against Russia following its invasion of Ukraine, including a first ban on Russian gas shipments that could impact the flow of fuel to buyers in Asia.

The ban targets the transshipment of LNG—the transfer of cargoes from one vessel to another—at European ports, but it does not ban imports of liquified gas into the EU.

The sanctions are aimed at cutting Russia’s revenue stream and hampering its war effort in Ukraine, though the effect will likely be measured in millions rather than billions of euros.

Gas market stakeholders say the transshipment ban won’t hit supplies to Europe, which continues to import cargo from Russia. However, it no longer makes direct fuel purchases through pipelines and has banned importing oil products.

The gas market itself has reacted quietly to the news. Front-month TTF natural gas futures traded at €34.500/MWh on ICE Endex at mid-morning on Thursday, giving a week-to-date gain of 1.7%. Traders continue to monitor supply from the North Sea and US Gulf, as well as demand from Asia, as the main market inputs at the moment.

European gas storages were 76% full as of June 26, close to their levels on the same day a year ago. There appears to be a consensus that the minimum mandated level of 90% will be reached well before their November 1 deadline.

Nonetheless, European gas prices remain vulnerable to any interruptions in supply. Unscheduled outages in the North Sea have already triggered price spikes this year, and interruptions in shipments from the US have also led to increases.

How does this affect EUA prices?

Since the gas supply appears comfortable, front-month TTF prices have settled into a range of around €35/MWh for the last month. This is still well above historical pre-2022 averages, which are closer to €15/MWh, but the rest of the energy complex is also higher. Year-ahead German baseload power has typically moved around €50/MWh, but the calendar 2024 future is around €90/MWh these days.

Coal has risen to around $115/tonne, well above its pre-2022 historical average and closer to $70/tonne.

This has shifted the operating profit for power plants across Europe, and as things stand, gas is marginally favored over coal as a generating fuel.

Data showing a more than 20% year-on-year decline in coal-fired power generation across the EU so far this year supports this. With gas generating around half as much CO2 as coal, demand for EUAs is, therefore, comparatively lower.

The narrow differential between the generating speeds for gas and coal has effectively floored the price of gas and, in turn, carbon.

The short-term outlook doesn’t suggest much change is in store. Gas prices will continue to react to supply and weather events across Europe that will drive cooling demand, while carbon prices may see some volatility develop as the compliance demand season is expected to reach its height in July and August.

Carbon Market Roundup

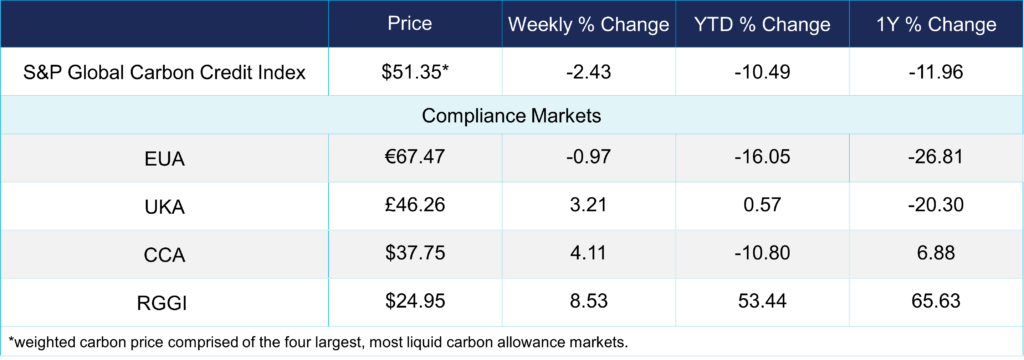

The weighted global price of carbon is $51.35, a decrease of 2.43% from the previous week. EUAs fell by 0.97% to €67.47, while UKAs increased by 3.21% to £46.26. CCAs rose by 4.11% to $37.75. RGGI ended at $24.95, up 8.53% from the prior week.