Drivers Behind November EUA Price Action

3 Min. Read Time

November posed some challenges for the EU ETS as front-year contract prices fell by over 10% to €70.81, driven by short selling amid a gloomy macroeconomic outlook and a 20% drop in European fossil fuel generation. Despite this, potential catalysts for recovery include expected decreases in interest rates, short positions potentially being covered, and profit banking, all of which may positively influence prices.

Data from the European grid association, Entso-E, show that fossil-fired power generation across the EU gas dropped by around 20% in the ten months to the end of October, while renewable generation has climbed 6.7%. To break this down further, lignite-based generation – the most carbon-intensive fuel – is off more than 25%, while hard coal power has dropped nearly 25%. Even lower-carbon generation from natural gas is down by 16%. And with almost half the emissions from the EU ETS coming from the power sector, this drop in emissions has weighed on EUA demand. Analysts are projecting that total emissions in the EU ETS will fall by over 150 million tonnes. Europe's poor economic performance this year has also depressed industrial activity: the purchasing managers' index has been below 50 since late 2022, suggesting a decline in output, and analysts are confident that industrial emissions will have also fallen this year.

Also, earlier this week, RWE, Europe's largest emitter, announced that it had closed its "strategic hedge" on carbon as it redirects its focus to building out its renewable technology business. The company's commitment to transitioning away from fossil fuels is a testament to the influence of climate policy and carbon pricing, though it does mean that they may not need to hedge their long-term exposure or buy as many allowances in the future. However, RWE said that going forward, it would still manage its remaining carbon exposure as part of its trading operations, so we may expect more volatility if it takes a more dynamic view on its position.

We could see more buying activity from investment funds as they cover some of their short positions before the Dec '23 contract expiry on December 18. Data from the two main European futures exchanges show that funds have been net short EUAs for the last 17 weeks – since early August – with their position reaching a record of 33.4 million tonnes of net short (27 million in longs and 60.4 million in shorts) in the week ending November 24. Funds have never held a net short position this close to the expiry of the front-year futures contract, so there is still a possibility that funds will cover at least some of their short before then. Fund managers are likely to want to also bank some profit from EUAs' price decline since mid-August, which may drive some more buying.

The outlook for gas prices is also critical to an early rally in carbon. Prices for TTF natural gas have come down sharply in the last few weeks as Europe's reserves are still near maximum levels despite the onset of colder weather. Any sustained cold snap will surely draw down supply from storages and could force prices higher. Higher gas prices mean coal is more competitive, which could lead to more carbon emissions from power stations.

Macroeconomic factors may eventually help the market recover from its recent slump as well. With European interest rates looking more likely to come down sooner than anticipated, thanks to better-than-expected inflation data from many parts of the EU, this may revive industrial output and demand for electricity, helping to drive overall EUA demand.

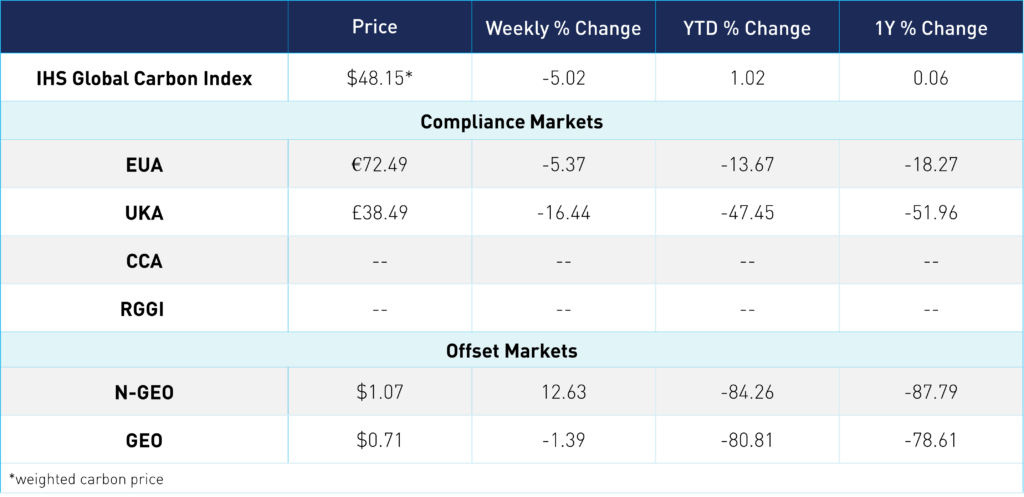

Carbon Market Roundup

The global price of carbon is $48.15, down 5.0% for the week. EUAs are down 5.4% from the week prior at €72.49. UKAs are down 16.4% at £38.49. On Wednesday, the Dec-23 V23 RGA contract settled at $14.85, slightly below the CCR trigger price of $14.88. This week, RGAs have consistently reached or matched record prices, surpassing the CCR trigger price. Opinions varied on factors contributing to the continuous RGA record prices, including expectations of a tighter market next year and the upcoming Q4 2023 RGGI auction scheduled for December 6. N-GEOs are up 12.6% at $1.07, while GEOs are down 1.4% at $0.71.

Note: We were having technical issues retrieving US prices from Bloomberg today.