Market Signals Driving 2023 EUA Price Action

3 Min. Read Time

As the European carbon market enters the new year, attention is beginning to shift toward the annual compliance cycle and industrial demand.

Under EU ETS rules, entities covered by the cap-and-trade system must independently verify and report their emissions for the previous calendar year by the end of March and surrender EUAs covering those emissions by the end of April.

This schedule usually leads to an uptick in activity in Q1, with trading volumes in the spot and March futures contracts increasing as industrials complete their emissions accounting and buy any remaining EUAs they will need.

2022 was an unusual year in that emissions from industrial production are widely believed to have fallen amid soaring natural gas/ energy costs and a looming recession. Meanwhile, emissions from the electricity sector are estimated to have risen from the switch from natural gas to coal for power generation.

This fuel-switching trend may offer some support to the market as traders look ahead to 2023. There’s likely to be little change in the power plant operating merit order in the short term since, while gas prices have fallen sharply from their 2022 highs, they are still not low enough to be competitive as a fuel for generation.

Here are a number of factors that will likely help determine the price action for EUAs over the coming months.

Bullish – At the start of the year, many traders will be building new positions after getting their 2023 trading mandates. After a volatile 2022, there may also be a reorganization of portfolios and some new entrants into the market, which may bring new demand into the market.

Bullish – A number of analysts have suggested that the 2022 certified emissions data will show an overall increase in verified emissions for 2022, compared to 2021’s 1.307 billion tonnes. With a total EUA auction and allocation supply last year of 1.011 billion tonnes, this suggests a sizable reduction in the market’s historical oversupply.

Bearish – However, the supply-demand outlook for 2023 is clouded by the EU’s agreement to bring an additional €20 billion worth of EUAs to market over the next three years as part of its REPowerEU initiative. At current prices, this means as many as 250 million additional EUAs could come to market over the next 36 months.

Added to this is the overall uncertain macroeconomic outlook, which will hang over the market and may dissuade speculative traders from taking bullish positions.

Bullish – But it’s worth noting that some of the 250 million REPowerEU EUAs will represent member state auction volumes brought forward from the 2027-2030 period, meaning that auction supply in that later period will be tighter.

The market will probably mark time until the European Commission publishes more details of the timing and size of the REPowerEU auctions, likely by the end of Q1 after the legislation has been signed off by EU member states and become law.

Bullish – The agreement at the end of December on the “Fit for 55” reform package will lead to a host of changes to the EU ETS in the medium term. Read more about these changes in our previous blog here.

Uncertainty also hangs over the power sector. While Europe appears like it will get through winter with healthy natural gas supplies due to milder-than-predicted temperatures, the lack of Russian gas flows will continue to dog the market.

January has begun on a weak note, with benchmark gas and power prices falling by 7% and 17%, respectively. Levels are still well above where they were a year ago, and coal remains the favored fuel for now, which supports EUA demand.

LNG supply to Europe has been healthy, particularly due to relatively modest demand from other buyers such as Asia. A resurgence in demand from other parts of the world will likely spark a run-up in LNG prices, reviving the threat of industrial slowdowns and keeping coal firmly in the driver’s seat.

Carbon Market Roundup

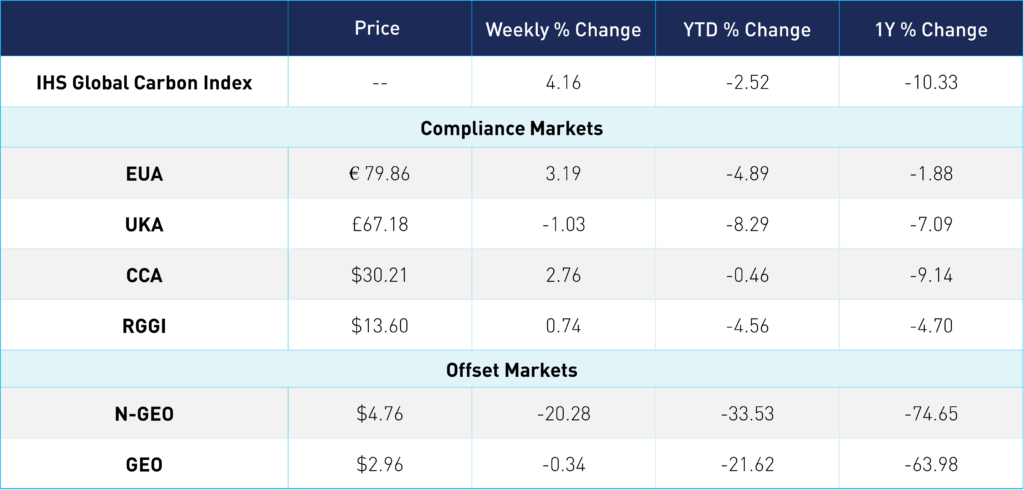

EUA prices jumped 5% on Monday and then traded within a fairly narrow range during the rest of the week, closing at €79.86. UKAs were also up at the start of the week but fell slightly in the last few days to end at £67.18. Meanwhile, CCAs were up +2.76% and closed at $30.21. RGGI had been on a downward trend since the start of the year but picked back up this week, to close at $13.60. As for offsets, N-GEOs have been trending down over the last two weeks, ending at $4.76, while GEOs traded in a narrow range to end at $2.96.