Aviation Industry’s Net Zero Pledge to Boost Offsets, OPEC to Cut Oil Production

3 Min. Read Time

Climate/ Carbon News

OPEC Crude Oil Production Cut Pushes Energy Stocks Higher

The Organization of the Petroleum Exporting Countries (OPEC) plus allies, including Russia, announced plans to cut oil production in an attempt to encourage a recovery in oil prices. Recessionary fears have pushed crude prices down to $80 a barrel from the $120+ level in early June. Crude rallied following the announcement, driving prices near $95.

This comes despite attempts by the US to persuade Saudia Arabia, the largest petroleum exporter, and OPEC de facto leader, against such action. In response, the Department of Energy is scheduled to release another 10 million barrels from the Strategic Petroleum Reserve next month. OPEC's decision also highlights the importance of strengthening US energy independence and scaling up domestic renewable energy capacity. So far, the impact on the carbon markets has been muted, though supply cuts could mean reduced emissions as industry and consumers face higher prices. If that occurs, carbon markets could see some macro impact if higher oil prices serve as the "tipping point" for knocking us into a global recession, as the International Energy Agency (IEA) warned could happen in a recent report. However, production could be stepped up in other areas, as we are seeing now with talks of easing sanctions on Venezuela.

The aviation industry’s net zero pledge may create explosive growth for offsets

This week, the International Civil Aviation Organisation (ICAO), a UN agency, pledged to work towards an “aspirational goal” of achieving net zero emissions from global aviation by 2050.

The concept of “net zero” means cutting greenhouse gas emissions to as close to zero through emissions reductions and removals, with any remaining emissions re-absorbed from the atmosphere through offsets. This is identified as the 2050 goal by the UN Paris Agreement, which was based on scientific consensus at the Intergovernmental Panel on Climate Change (IPCC).

ICAO’s pledge is officially termed a “long-term aspirational goal” and will lean heavily on emerging technologies and improved practices, such as sustainable fuels derived from renewable sources and innovative aircraft technologies, but it will most likely also look to carbon markets to reach the target.

In 2016, ICAO launched a carbon market to limit emissions from aviation, known as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

CORSIA sets a baseline for 2019 emissions and requires operators in 118 participating countries to offset any emissions above that level. (To be clear, ICAO’s meeting this week also agreed to reduce the CORSIA baseline to 85% of 2019 emissions from 2024, further boosting potential demand for offsets).

Analysis by the German government in 2020 estimated that the total demand for carbon offsets from the CORSIA market could total 2.7 billion tonnes between 2021 and 2035. For comparison purposes, the total offset supply in 2021 was estimated at around 500 million tonnes in 2021, according to Ecosystem Marketplace’s State & Trends of the Voluntary Market report.

Since CORSIA only addresses emissions growth over and above the baseline of 2019, a “net zero” approach would probably need to broaden the market’s scope to address all emissions from aviation, which could lead to explosive growth in aviation’s demand for carbon offsets.

CORSIA currently limits the eligibility of offsets to pre-approved project types governed by specific standards organizations, though these restrictions might have to be relaxed if aviation demand increases.

ICAO isn’t expected to issue any concrete proposals to achieve its net zero pledge any time soon, and it’s not clear yet whether a net zero goal will lead to an increase in the scope of CORSIA.

However, with the corporate world increasingly turning to carbon offsets to achieve neutrality, it seems reasonable to expect that the global aviation industry will also do so, which could be a potential catalyst for offsets.

Carbon Market Roundup

Compliance Markets

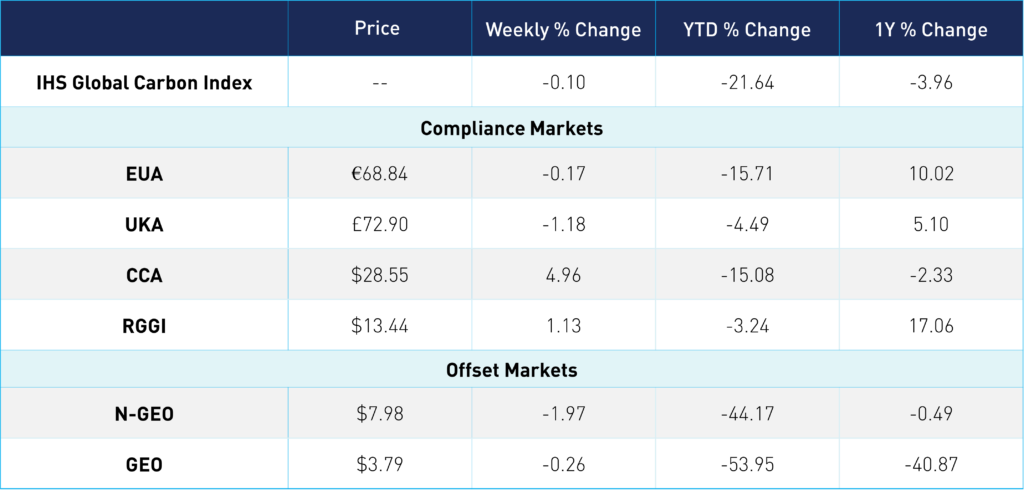

Both EUAs and UKAs fell on Monday but regained most of their losses by Thursday's market close, ending at €68.84 and £72.90, respectively. On Monday, EUAs saw a 4.4% drop--the largest one-day price decline in the past 2 weeks, while UKAs fell just under 4%. Both continued to fall into Tuesday and then turned a corner Wednesday. As for US markets, CCAs climbed steadily over the week, +4.96%, closing at $28.55, and RGGI was flat, closing at $13.44. US markets appeared unaffected by September's CPI release and the OPEC supply cut news.

Offsets Markets

Nature-based offsets, N-GEO saw a slight decline, -1.97%, to close at $7.98. Meanwhile, GEOs remained relatively flat for the week, off just -0.26%, ending at $3.79.

Carbon Futures Prices